- Part one of our week-long series looking at the Island’s super-rich immigrants

- Jersey welcomes multi-millionaires under States High Value Residency scheme

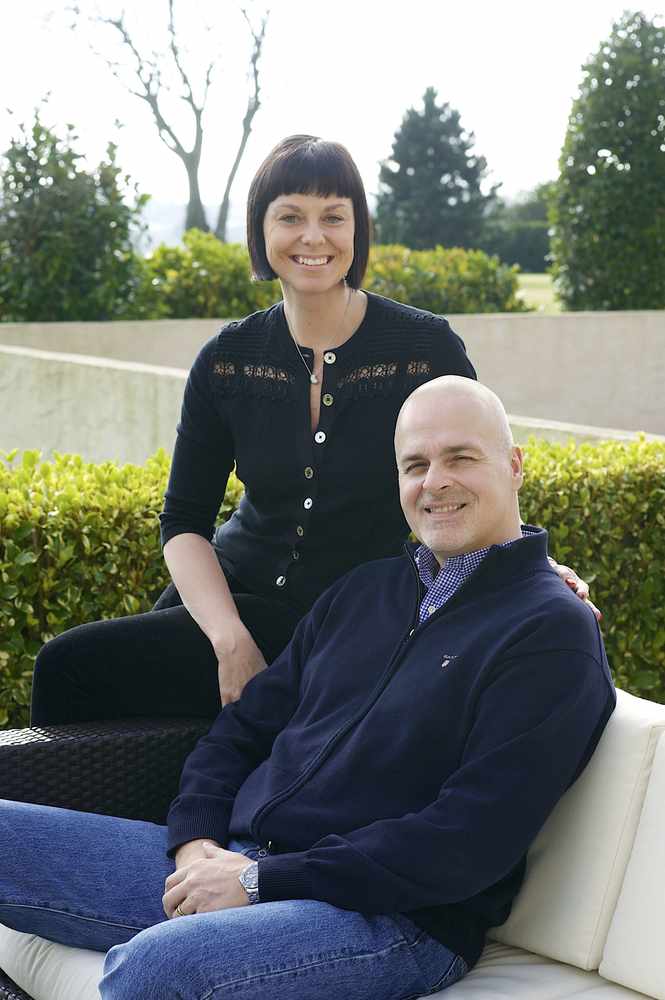

- Meet Mark Proudfoot, a recent arrival in Jersey who has defended the scheme

- Is the scheme of benefit to Jersey? Take part in our poll below

JERSEY’S super-rich immigrants contribute around £10 million per year in taxes under a scheme that has been defended by one of the Island’s wealthiest newcomers.

Multi-millionaire Islander Mark Proudfoot has spoken out in support of the States High Value Residency scheme, which aims to attract wealthy individuals and businesses to Jersey by offering a beneficial rate of tax for high earners.

In the first of a four-part series which examines the regime, its set-up and economic benefit to the Island, Mr Proudfoot (52) describes how he built his fortune and why he decided to move to Jersey from Switzerland – a move that meant a higher annual tax bill.

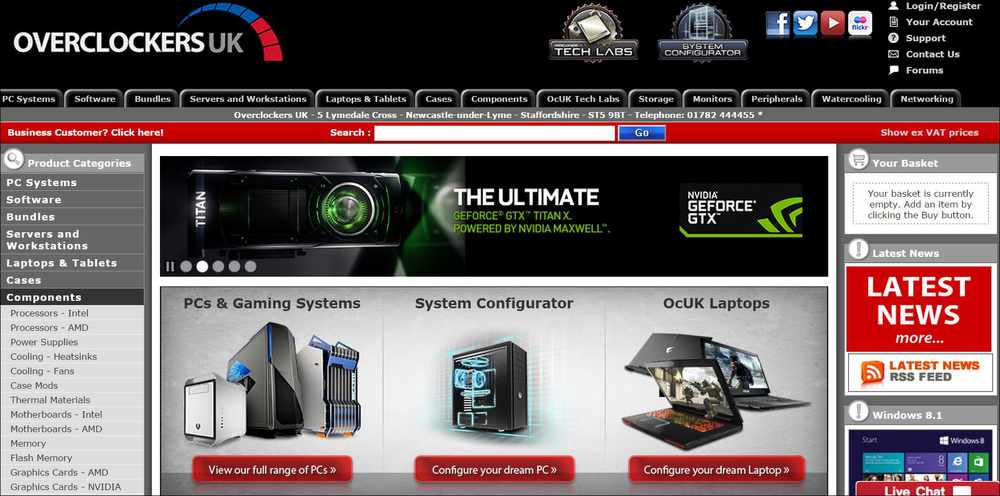

Mr Proudfoot, who set up a successful computer tech company after working as a car salesman and a dealer of classic and collectable firearms, said that there was no down side to Jersey’s high net worth programme as the Island gained good annual tax returns, with new arrivals going on to spend large sums with local businesses.

New high-value residents, who must first go through a formal application process, are charged a 20 per cent flat tax on their first £625,000 in earnings and then one per cent on any amount above that, meaning they pay a minimum of £125,000 in tax each year.

Mr Proudfoot said: ‘The perception that people have that people like me are coming over here and getting away with paying less tax is nonsense. Tax, for me, has increased.

‘On top of that, high value residents support local businesses by renovating homes, building garages or extensions, by paying for decorators and using local suppliers.

‘I think if we did the sums the HVRs coming in put a tremendous amount into Jersey’s economy. And we don’t take anything out.

‘It staggers me that people like those in Reform Jersey think that that could end. All that would happen is that there would be less money in Jersey for everybody.’

Now, Reform Jersey say they are due to propose a rise in the basic tax take from high value residents in the hope that their minimum contribution would go up to £150,000 per year rather than £125,000.

In 2012 Deputy Geoff Southern, a member of Reform Jersey, proposed changing the one per cent top up tax on earnings over £625,000 to three per cent, but his suggestion was rejected by the House.

Deputy Southern is due to lodge another proposition in the coming months.

AS a member of Britain’s three-million-strong army of unemployed in the early 1980s, life as a young adult in the Margaret Thatcher era was tough.

But it was those years that Mark Proudfoot says made him who he is today.

The 52-year-old is one of Jersey’s newest high-value residents, having arrived from Switzerland last year after selling his technology business.

He and his wife Claire live in St Lawrence in a converted farmhouse that overlooks the south coast.

‘We were quite happy in Switzerland and eventually sold the business in 2011. While we were there in 2013 we had a conversation one day about where we would like to live.

‘Somebody suggested Jersey, which I first thought would be a bit like Guernsey – quaint, but you wouldn’t want to live there,’ says Mr Proudfoot.

‘In December 2013 we decided we really liked what we saw and made our application for residency.

‘We bought our house in June 2014, but didn’t move in until September.

‘I’m now very keen to get back into business – not in computers, something Jersey-based. I’m not really interested in having a business outside of Jersey, as I feel so strongly about the Island as a place to live’

‘The qualities Jersey has are so abundant that I want to put down more roots here.

‘When you make an application for high-value residency it’s quite a rigorous process. It’s not just about money. It’s worth pointing out that my personal tax bill has almost doubled since moving to Jersey from Switzerland. Our move was about quality of life rather than saving money.’

Mr Proudfoot, who says he hopes to start a family and put down roots in the Island, explained that the application for high-value residency required a business profile of what he had achieved during his career and a personal letter that explained why he wanted to move to Jersey.

‘In writing that, what you’re really saying is what you like about Jersey and what you can put back into the community. I have always had a longing for years and years to become part of a community, and that was quite difficult in Switzerland, but over here it seems much easier.

‘I think that what is also appealing about Jersey is that you have so much freedom of choice and so many opportunities to do different things with your leisure time and business time.

‘People here have an active lifestyle. It appears there is a real thirst for life here, and that’s quite addictive. Then there’s the natural beauty of the Island, the fabulous restaurants and a real sense that there is something going on all the time.’

Mr Proudfoot’s high-value status has been a hard-earned achievement, which came after he had set up and run a string of businesses following a two-year period unemployed.

‘I was one of Thatcher’s unemployed, and those two years really helped to make me who I am today,’ he said.

‘I was hard up and didn’t like it and never wanted to be hard up again.’

After growing up in Cheshire, he moved to Devon at the age of 21 and began a career as a car salesman.

‘I was there for a few years and then moved back up to Cheshire, got promoted and had a career in office equipment sales.

‘I progressed up the ladder and then started my own business doing the same thing.

‘Over the years after that I had a number of different businesses, including being a firearms dealer. The businesses were pretty successful, but I wasn’t making millions.

‘I moved to Switzerland for a couple of reasons – I knew selling there would be advantageous, but I also wanted to leave the UK, as I thought there were nicer places to live in the world.

‘My motivation has always been to be the best – always either to offer the best product or services. It’s not just been about money, but about getting satisfaction from work.

‘With the computer business I created a solution for providing the best components and best machines. If you want to be the best at something you don’t have to reinvent the wheel, you just have to do something better than anybody else is doing it.’

For a period the businessman imported high-end guns for collectors and enthusiasts – a move borne out of his own interest in shooting and the sense of frustration that a huge range of models was not available in the UK.

Mr Proudfoot said: ‘I’ve been a keen shooter all my life, and back in the late 1980s I became frustrated that some of the guns you saw advertised in US magazines were not available in the UK.

‘So I decided I would quite like to import them and thought there was money to be made there. We’re talking about very high-quality firearms.

‘So I rang the US embassy in London and said I wanted to trade with American companies. I got through to the right department and the friendly guy I got through to, it turned out, used to be an arms dealer in the United States. He helped me set up the business. He provided contacts and helped me set up a US bank account.

‘That went on for a few years and then I opened a shop, and that shop did pretty well.

Mr Proudfoot has nothing but praise for the Island’s high-value residency programme, a view that challenges the beliefs of back-bench politicians who have questioned the regime for years.

He said that the policy only benefited the Island, adding: ‘I think it’s back to the green-eyed monster, resentment and jealousy that makes people think we are somehow “getting away with it”.

‘It’s not getting away with anything, it’s about being attracted to a tax-beneficial environment and that environment benefiting greatly as a result.’

Commenting on the latest version of Jersey’s strategy to attract wealthy individuals and families, Reform Jersey member Deputy Geoff Southern said: ‘The desire to attract high-net-worth individuals to the Island in the 60s and 70s led to arbitrary deals being done over tax, which today would be seen as unsustainable, often with fixed sums with no index-linking over years.

‘However, there has been no consideration to index-linking this sum to compensate for “fiscal drag” through inflation.

‘In the 2016 budget, when the Treasury Minister will be exploring all ways of raising revenues to counter the structural deficit, Reform Jersey will propose a further rise (above inflation) in the sum of £125,000 to, say, the order of £150,000.

‘Following the 2011 rise in the tax rate for these revenues, we have seen increasing numbers of high-net-worth immigrants coming to the Island, so we have not yet priced ourselves out of the market.’