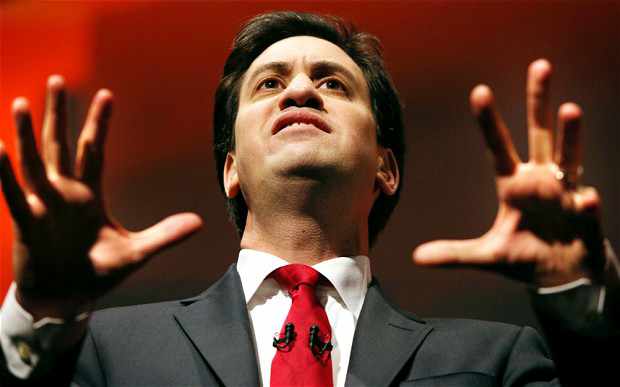

leader Ed Miliband that the Island is failing to adequately meet international tax regulations.

Mr Miliband has promised that should his party win the general election in May, he will demand that UK offshore finance centres, including Jersey, are put on the Organisation for Economic Co-operation and Development blacklist unless they produce a public record of offshore company ownership within six months.

However, Chief Minister Ian Gorst has said the Island is at the ‘front of the fight against tax evasion’ and that any threats to blacklist Jersey are ‘difficult to understand’.

The Labour leader said that he would be sending a letter to the Crown Dependencies putting them on notice about his plans.

‘We are going to give six months to these tax havens to agree to publish a register of beneficial ownership, and if they do not act we will recommend to the OECD that they are put on a blacklist.’

Senator Gorst has defended the Island’s stance on tax avoidance and suggested that Mr Miliband has not properly understood the current international tax regulations.

He said: ‘We need to ensure that we are doing what we can to make sure that Jersey is not being used for tax evasion and we believe that we have a strong system and strong regulations already in place.

‘It is difficult for us to understand what the Labour leader is saying. We are on the OECD working group and those credentials speak for themselves.’

An international blacklist is designed to single out those jurisdictions that are uncooperative, and being listed on it damages the jurisdiction’s’ reputation for business activity.

In 2013, Jersey was placed on the French tax blacklist, but was removed a few months later.

Senator Gorst added: ‘As the UK Chancellor has said, it is not clear that the Labour leader fully understands what is happening in relation to tax regulations.

‘We already have a central register of beneficial ownership, which the UK does not, and the EU is not calling for that to be a public register. I cannot see why the OECD would place us on any blacklist.’

Meanwhile, Geoff Cook, chief executive of Jersey Finance, has said that a public register of company ownership would not be the best move.

He said: ‘Jersey has captured beneficial ownership information on a corporate registry since 1999 and this information is available to law enforcement agencies.

‘Jersey’s ability to capture ownership information of companies is far ahead of those available in other onshore and offshore jurisdictions including the UK, which is so far alone in calling for a public registry.

‘We believe a public registry will be of dubious value, will be bypassed by criminals and those who misuse companies to launder money and for tax evasion purposes, while data will be unreliable.’

He added: ‘Jersey adheres to current international standards and is already a global leader in capturing and exchanging such information.’

The States of Jersey will invite the Labour leadership to the Island to discuss the current tax situation.

When Barack Obama was first elected as the President of the United States in November 2008, his success was causing concern among senior finance industry figures in Jersey.

There were fears that he would act on his threats to ‘shut down’ offshore jurisdictions – a key message during his election campaign.

During his campaign, Obama said: ‘I shall shut down those offshore tax havens and corporate loopholes as President, because you shouldn’t have to pay higher taxes because some big corporations cut corners to avoid paying theirs.’

He was speaking in support of the Stop Tax Haven Abuse Act, a bill that named Jersey, Guernsey and the Isle of Man as ‘offshore secrecy jurisdictions’ which had helped American citizens and businesses evade US tax.

It proposed to take very tough action against such jurisdictions and those who use them.

‘I am not going to back down. The time has finally come to put an end to a society in which one group of people can play by different rules to the rest.’

‘There is nothing pro-business about defending tax avoidance. Millions of British people and businesses pay their taxes and they are damaged by this behaviour.’

‘For this to be portrayed as anti-business is ridiculous. What I am saying is what the Archbishop of Canterbury has been saying, the International Monetary Fund has been saying, and the OECD has been saying – a more equal society is a more efficient society. I believe in wealth creation and company profits, and for the government to play its part, and we have been working closely with business to shape that agenda.’

‘Cameron made this big promise 18 months ago that he was going to force UK tax havens in Crown Dependencies to open up and he has totally failed to meet that promise. We are sending a very clear message today. A Labour government is not going to have endless consultation and dithering. We are going to give six months to these tax havens to agree to publish a register of beneficial ownership, and if they do not act we will recommend to the OECD that they are put on a blacklist.’

WITH Ed Miliband desperately trying to align himself with the ordinary, hard-working elector – and with Tory rhetoric about his being anti-business becoming a major election theme – it was never going to be long before he set his sights on so-called tax havens.

In an interview published in The Guardian, a newspaper that has had an anti-Jersey agenda longer than it has been losing money, the Labour leader said that he would give the Crown Dependencies six months to publish a register of the beneficial ownership. Those which failed to comply, he said, would be named and shamed, with the UK recommending that they be blacklisted by the OECD.

It is right that tax avoidance, tax planning or whatever you choose to call an activity which is 100 per cent legal is on the agenda, but Mr Miliband should get his facts right before he takes a cheap shot at Jersey.

As Chief Minister Ian Gorst said in a strong response, Jersey has led the way in meeting international best-practice standards. Anyone who doubts that should speak to the IMF, the OECD or a number of other expert bodies.

There are few less trustworthy things in life than a politician at election time. Misleading half-truths masquerading as fact are their currency used to pay off voters largely ignorant of the reality in places like Jersey, which trump the UK in many areas of regulation.

Mr Miliband should do his homework. As things currently stand, no jurisdiction publishes a registry of beneficial ownership. The UK and Denmark have signalled an intention to do so, but the detail is far from being agreed. The reality, a truth which the Labour leader has not acknowledged, is that Jersey is far ahead of the UK in meeting international standards of financial regulation and governance.

Jersey has left its more shadowy history of facilitating tax evasion far behind and, as the Chief Minister has said, is no advocate of aggressive tax avoidance.

Mr Miliband is in danger of starting an ill-informed witch-hunt against wealth creators that would damage the UK and its Crown Dependencies.

Jersey is rightly calling for a level playing field, something which can only be created through multi-lateral global measures. Time and time again, Jersey leads the way in adopting such gold standards. If Mr Miliband doubts that, he should bring his election roadshow over here for a proper debate.

*The JEP publishes a daily editorial comment each day on page ten of the newspaper.