Earlier this month Treasury Minister Susie Pinel announced proposals to move the two-thirds of Jersey taxpayers who pay on a prior-year basis – that is one year in arrears – to a current-year basis.

The move would see 2019 liabilities frozen until 2023 for those who switch and all ITIS and payments on account for 2020 used to pay this year’s tax instead. A range of repayment options for the frozen tax are being developed.

Deputy Pinel said that the Covid-19 crisis has brought forward long-mooted plans to move all Islanders to current-year basis, with the government claiming that doing so would help the many Islanders whose incomes have dropped substantially this year.

But critics of the move have said it would mean that Islanders moving to current-year basis would pay more tax sooner than they would have under the previous system and that it will damage the economy.

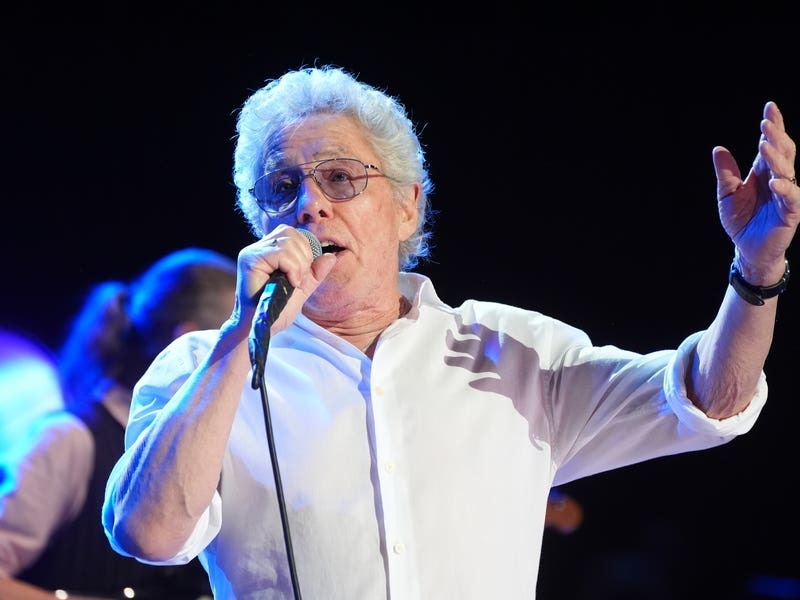

Former Senator Ben Shenton lodged a petition calling for those affected to have their 2019 liability written off altogether, which is what happened when Guernsey made similar reforms.

And over the weekend, the number of signatories topped 5,000, meaning that the States will now need to consider it for debate.

The Treasury Minister has said that if the petition’s proposal was adopted it would cost the Island £320 million in lost tax.

But writing on his Facebook page, Mr Shenton said that he believed the minister’s plans would set back efforts to boost the economy, such as the issuing of a £100 ‘spend local’ voucher to every Islander next month.

‘This is an extra £330 million they want to raise by bringing forward the final payment,’ he said.

‘Where is the logic in giving everyone a £100 voucher while announcing that they want to take £330 million out of the pockets of prior-year basis Islanders?

‘What will this do to the economy and the effects on the velocity of circulation of money? Have the Fiscal Policy Panel [the government’s independent economic advisors] looked at the implications?

‘Either write off the extra £330 million if they want to move everyone to current year at once, or leave the system as it is.’

Just three other petitions have managed to top 5,000 signatures and bring about a States debate since the online petition system was introduced in 2018.

These included calls to introduce tougher sentences for paedophiles, cap rents and to give cats greater protection against hit-and-run accidents.

The Treasury Minister had planned to lodge her proposals to move all Islanders to the current-year-basis tax regime for debate in October.

A date to consider Mr Shenton’s petition for debate has not yet been set.