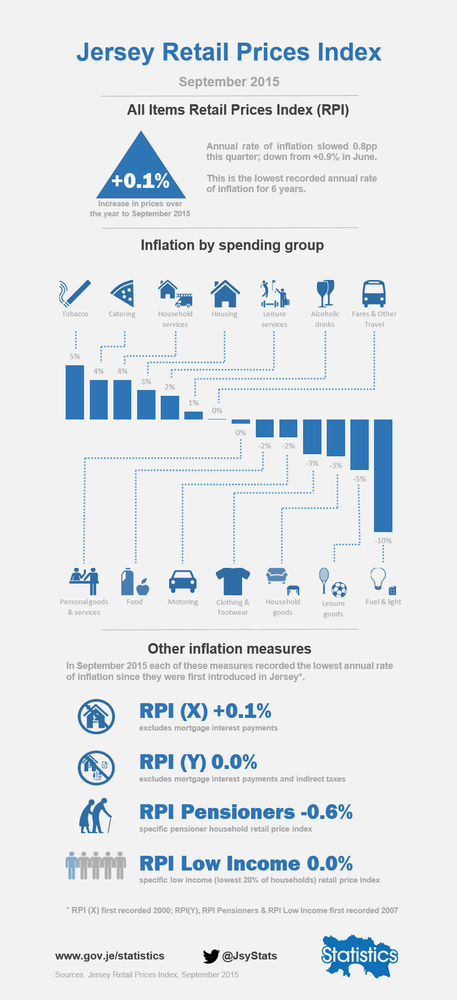

Official statistics reveal that inflation increased by 0.1 per cent in the last year – the lowest rate since 2000.

Food: -2 %

Catering: 4%

Alcoholic drinks: 1%

Tobacco: 5%

Housing 3%

Fuel and light: -10%

Household goods: -3%

Household services: 4%

Clothing and footwear: -3%

Personal goods and services: 0%

Motoring: -2%

Fares and other travel: 0%

Leisure goods: -5%

And with a report released over the summer showing that, on average, wages had increased by 1.8 per cent in the same time period, earnings can be seen to be outstripping inflation by 1.7 %.

It was even better news for pensioners, who saw prices decrease by 0.6 per cent – only the second time that deflation has been recorded in the Island since 2007. The pensioner index is calculated by examining the cost of goods regularly bought by pensioners.

Senior politicians have welcomed today’s figures – with Economic Development Minister Lyndon Farnham and Assistant Chief Minister Philip Ozouf saying the low rates were good for both consumers and businesses and that there was no immediate chance of the Island falling into potentially dangerous deflation.

According to the report, issued by the by the States Statistics Department Unit, the low rate of inflation has been driven by a drop in the price of food, which has decreased by 2%, and fuel and light, which has dropped by ten per cent – something mainly due to domestic heating oil falling by 19p per litre over the year.

Among the biggest cost rises were in tobacco (up five per cent), catering and household services, such as telephone bills and school fees – both of which had risen by four per cent.

Speaking about Jersey’s overall inflation rate, which is lower than that in the UK (0.9%) and Guernsey (0.5%), Senator Farnham said that Jersey found itself in a ‘couple of extraordinary situations’.

‘I very much welcome the figures,’ he said. ‘I think consumers are seeing the benefit of low commodity prices in many areas. We have a couple of extraordinary situations as we are seeing low inflation at a time of economic growth. Businesses really thrive in times of economic growth and low inflation rates are far more conducive to economic growth.

‘We are not at all concerned about deflation – I do not see it happening as long as we keep striving for economic growth. If our economic strategy goes to plan we should see inflation increasing slightly but remaining at a low rate, which will be of benefit to everyone. However, there is no room for complacency and we have a lot of hard work ahead.’

Meanwhile, Senator Ozouf said that the ‘unprecedented low inflation’ was positive for the economy.

‘The headline rates are obviously extremely encouraging from an inflation point of view,’ he said. ‘Taking out the financial crisis blip this is one of the lowest underlying rates we have ever seen.

‘People are benefitting from the low inflation rate as wages are rising at a much higher level than that of inflation. It is encouraging to see the food prices set internationally reflecting through to the Island, which has not always been the case.’

The Senator added that unlike elsewhere in the world, Jersey was well placed economically in the unlikely event that it did fall into deflation.

‘In Japan they have seen deflation which has been bad for the economy as they have had a lack of underlying growth.

‘We on the other hand are seeing positive levels of growth with our employment figures at record highs, so there are some real benefits to our current position.’