Australia’s REA Group has said it is mulling a takeover offer for Rightmove in a deal which could be worth about £4.36 billion.

REA Group, which is majority-owned by Rupert Murdoch’s News Corp, said in a statement on Monday that there are “clear similarities” between the companies, which have “highly aligned cultural values”.

Rightmove shares rose as much as 25% in early trading, boosting its market value by more than £1 billion.

REA Group said: “REA sees a transformational opportunity to apply its globally-leading capabilities and expertise to enhance customer and consumer value across the combined portfolio, and to create a global and diversified digital property company, with number one positions in Australia and the UK.

“There can be no certainty that an offer will be made, nor as to the terms on which any offer may be made.”

On Monday afternoon Rightmove said it had “not received any approach from REA about a possible offer for the company” and urged its shareholders not to take any action.

Founded in a garage in Melbourne, REA Group has become Australia’s largest property website with operations across the country as well as in India and south-east Asia.

Rightmove grew its revenue by around 10% to £364.3 million last year, while pre-tax profit rose 7.7% to £259.8 million.

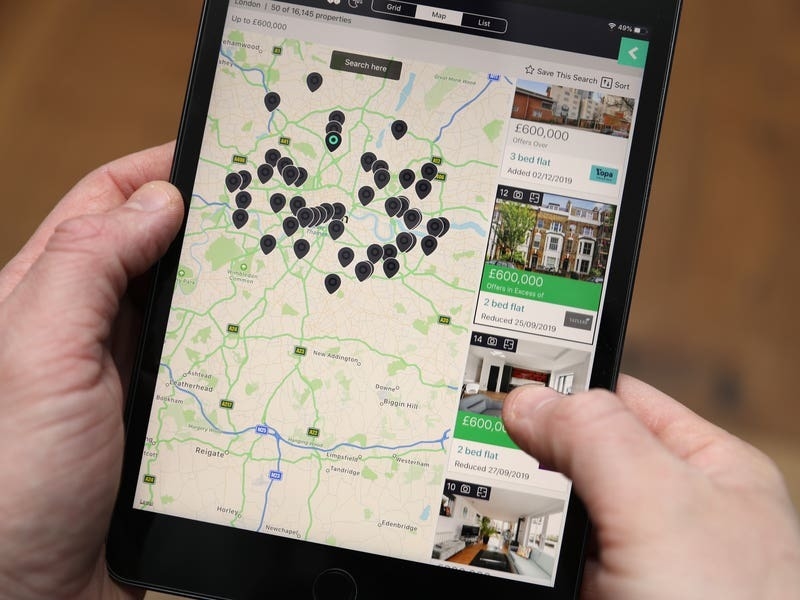

Its shares have remained broadly stable over the last year despite a depressed property market causing fewer people to use Rightmove to house-hunt, as it grew its average income per advertiser by nearly 10%.

REA Group has until September 30 to make an offer or walk away now that it has publicly expressed an interest.

Jessica Pok, an analyst at the investment bank Peel Hunt, said the approach “does not come as a surprise”, in part because the UK property market decline has kept Rightmove’s share price “subdued”.