Sponsored Content

Matthew Boxall of Team Asset Management offers this week’s market review.

It was another fascinating week in global financial markets with box-office entertainment provided by the US election result.

In what has been labelled by some as the greatest comeback in the history of American politics, Donald Trump stormed to a second US presidential election win on Tuesday, securing the popular vote, making him both the 45th and 47th US President. The Trump trade powered risk assets higher, with the bellwether S&P500 large cap index posting its 50th all-time closing high in 2024, with the index also passing the 6,000 milestone for the first time.

Investors saw the Republican victory as a firm signal to go “all in” on growth stocks. US Small Cap stocks, represented by the Russell 2000, rocketed to the upside as Trump’s focus on “America first” puts domestic stocks in the spotlight. Adhering to the America-first agenda, hopes for deregulation and reduced capital requirements for heavily regulated banks could enhance profitability, freeing up capital for dividends and buybacks, which would serve as a positive catalyst for the US banking sector.

The Trump trade continued across the crypto space as Bitcoin surged beyond $89,000, reaching a new all-time high. Once a vocal critic of cryptocurrency, President-elect Trump has since embraced it, now advocating for the United States to become the “Bitcoin and cryptocurrency capital of the world”. Support for crypto extends beyond the presidency, with a pro-crypto majority in both the House and Senate. Combined with the prospect of renewed deregulation, tax incentives and economic policies favourable to alternative investments, these conditions could set the stage for a sustained parabolic bull run in the crypto market.

Not all sectors benefited from the Trump catalysts as solar and electric vehicle stocks fell out of favour with the market. It is likely the regulatory and fiscal support for renewable energy will be softer compared to that under the Biden administration.

For EVs, regulatory support is also suspected to lessen under the Trump administration, causing further headwinds for the industry. The exception to this was Elon Musk’s Tesla, up almost 30%, though this was as much a “Musk trade” as about the company’s fundamentals given that Musk is arguably the man who did most to get Trump elected, other than the candidate himself.

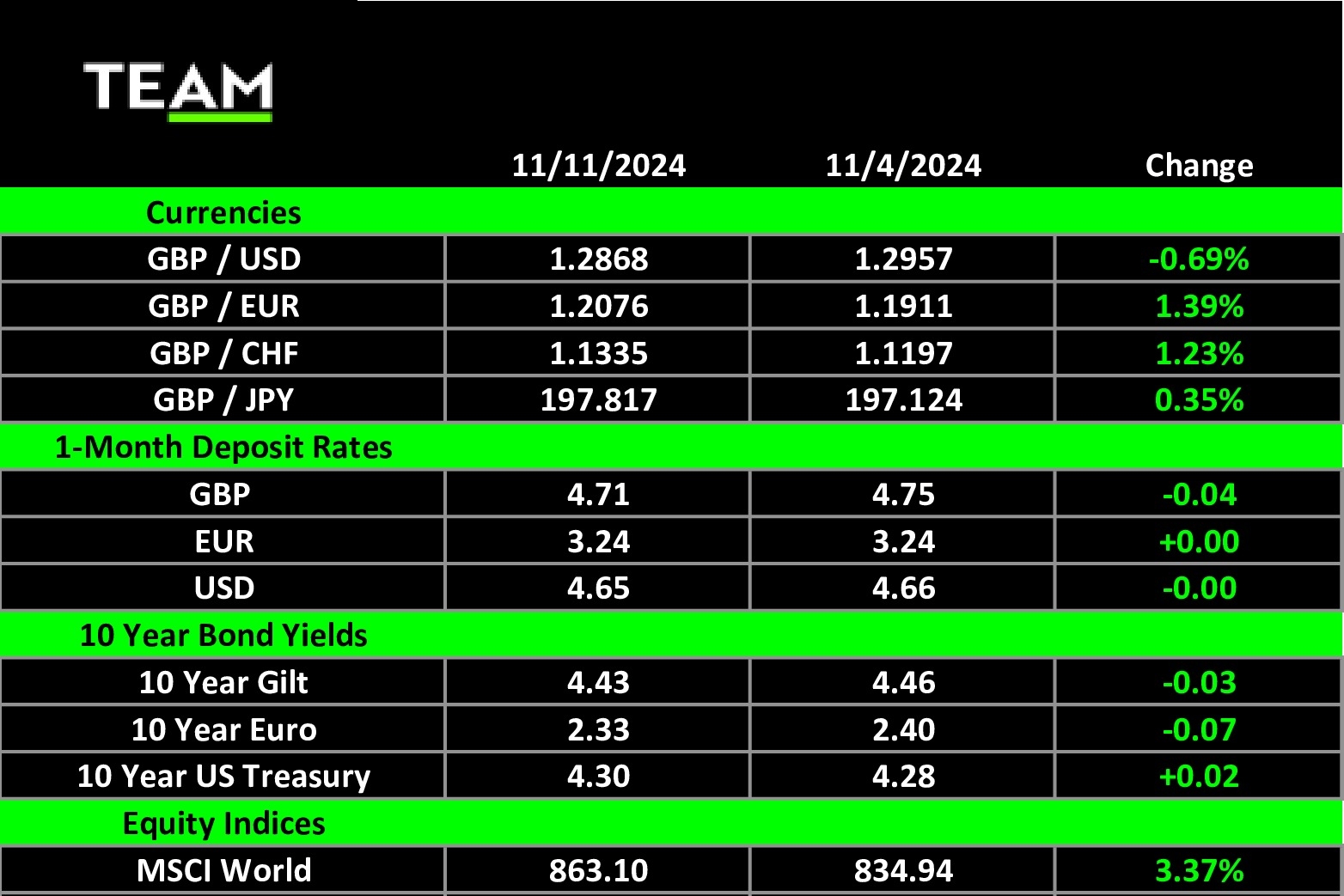

The spotlight shifted from the White House to the Federal Reserve on Thursday, but the risk-on trade continued into the end of the week as the US cut interest rates by another 25 basis points to 4.75%. Investors were left with little information regarding the next move from the Central Bank as there is uncertainty on how the US will look next year politically and economically under Trump. The noise already being whipped up around the potential end of the Federal Reserve is a sure sign of things to come.

Closer to home, the UK also cut rates on Thursday by 25 basis points to 4.75% in a widely anticipated move, but bond markets are treading more cautiously on comments from the Bank of England that it would reduce rates only gradually from here. The concern is that further aggressive cuts alongside the government’s new spending plans may fuel a second wave of inflation. The market now anticipates only three rate cuts next year and rates to stay higher for longer.

Meanwhile, China continued its efforts to restore confidence to the beleaguered property and stock markets with a further $1.4 trillion financial support package for local governments as it braces for heightened trade tensions with the incoming US administration, which has threatened a 60% import tax on Chinese goods.

Despite previous setbacks, recent policy measures undertaken by authorities in China, including rate cuts and support for stocks and property, are beginning to show positive effects, with housing sales, business activity and stock values improving.

Looking into the week ahead, a combination of economic and corporate earnings will be in focus as the UK unemployment rate, US inflation data released today and UK GDP and US retail sales numbers on Friday, alongside earnings from several high-profile names including Walt Disney and Spotify.