Sponsored Content

Andrew Gillham of Team Asset Management offers this week’s market review

Stock markets endured their worst week in two months as investors tried but failed to climb a wall of worry headlined by geo-politics, company earnings and precarious government finances, put under the spotlight during the UK government’s autumn budget. The blue-chip S&P500 fell 1.9% and the technology-focused Nasdaq index retreated 2.1% from a record high set last week.

While it seemed much had been leaked in the run-up to the Labour government’s first budget in 14 years, the reaction to the “tax and spend” measures suggests that there were some nasty surprises that were not expected.

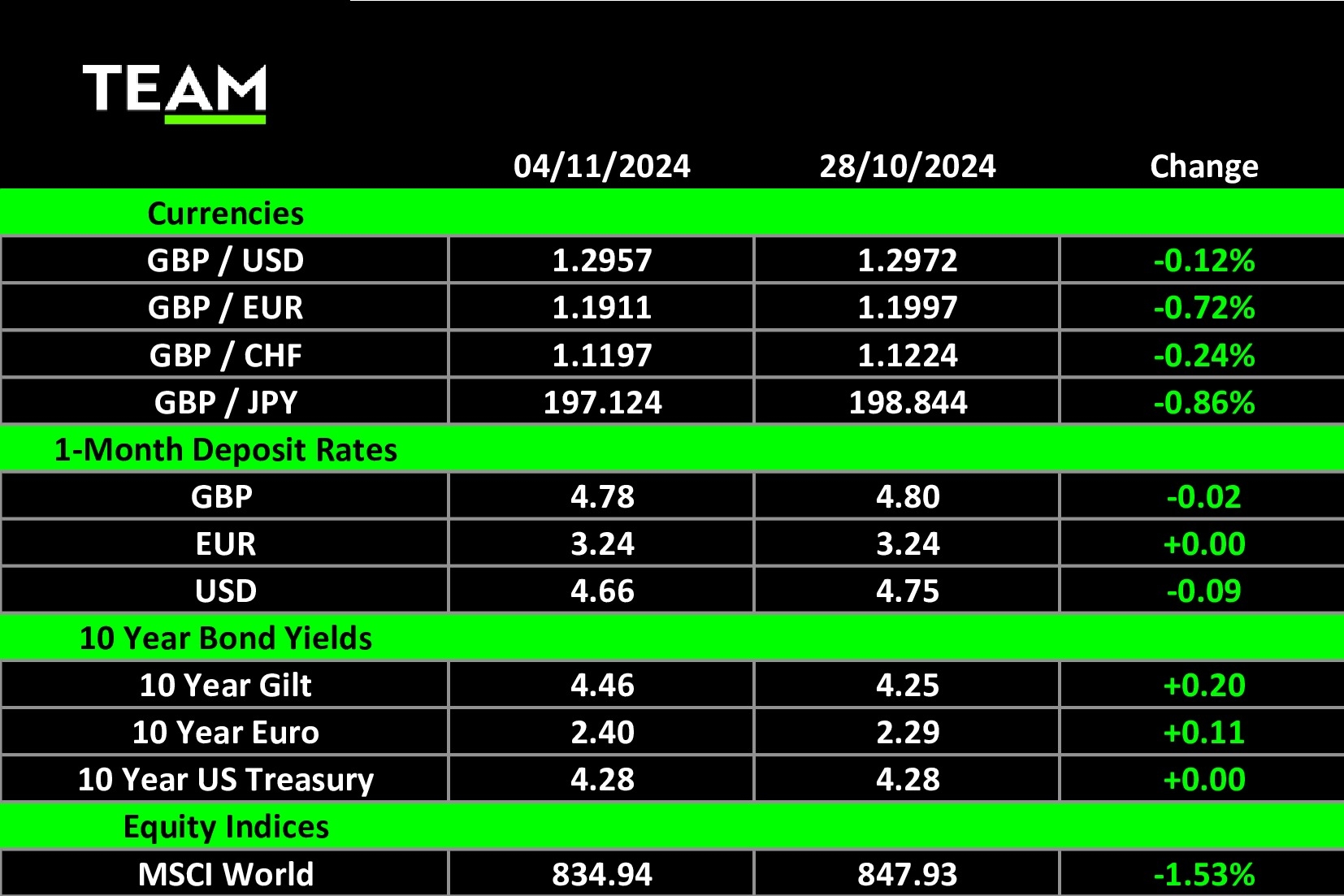

The Office for Budget Responsibility labelled the additional £140 billion of borrowing over the next five years as “one of the largest fiscal loosenings of any fiscal event in recent decades” with the sales of UK government bonds expected to reach £300 billion this year to cover the shortfall in government revenues versus their spending commitments. The spike in UK government bond yields to their highest levels this year, however, cannot solely be attributed to the budget, with external factors also in play, led by a firming of the “Trump Trade” in the run-up to the US elections. The former president is expected to pursue lower taxes and higher tariffs if re-elected, both of which risk fuelling inflation.

Away from politics, it was a big week for third-quarter corporate earnings reports, headlined by tech giants Google’s parent Alphabet, Amazon, Apple, Meta Platforms and Microsoft. The Nasdaq had ascended to an all-time high prior to their release and maybe it was a case of “buy the rumour, sell the news”, as forecast-beating results were met with a mixed reception.

Amazon was the standout performer, gaining more than 6% on Friday after it reported a double-digit rise in quarterly revenues, driven by growth in its cloud computing, Amazon Web Services and advertising businesses. Chief executive Andy Jassy asserted that the rush to develop generative artificial intelligence tools had created “an unusually large, maybe once in a lifetime, opportunity” for its cloud business and its AI business, which is seeing “triple digit” revenue growth.

The AI rush requires the big tech companies to spend heavily on capital expenditure to keep up and the market reaction to Microsoft’s (-6%) earnings was much less kind. Microsoft almost doubled its spend on investments, such as data centres needed to train and run powerful AI language models, to $20 billion during the quarter, which could weigh on profit margins over the near-term.

Apple shares also fell (-2%) on Thursday after it provided some more cautious sales guidance for the crucial holiday season. While revenues from the iPhone, whose accounts were almost half of Apple’s overall sales, grew 6% to $46.2 billion during the quarter, insufficient new AI features on its latest iPhone 16 model may put off some users from upgrading their smartphones in this cycle.

It was also revealed that one of Apple’s largest shareholders, Warren Buffet’s Berkshire Hathaway, continues to reduce its stake in the company. Berkshire held $69.9 billion worth of Apple shares at the end of September, implying that it offloaded around a quarter of its holding during the past three months.

The “Oracle of Omaha” has not disclosed his reasons for selling down his Apple shares, although he has voiced concerns that capital gains tax could increase over in the future, and Berkshire Hathaway is now sitting on a cash pile of more than $325 billion.

M&A speculation was also moving stocks during the week, and shares in Burberry jumped 5% on Monday after reports emerged over the weekend that Italian rival Moncler is interested in acquiring the UK luxury fashion brand. Shares in Burberry have fallen by almost 50% this year amid a global slowdown in demand for luxury goods which might present an attractive entry point for interested buyers.

In commodities markets, brent crude climbed $3 to $75 a barrel on Monday after OPEC agreed to delay a planned increase in output by a month.

The cartel, led by Saudi Arabia, will extend its output cut of 2.2 million of barrels per day through to the end of the year to await more clarity on the path of interest-rate cuts and stimulus measures in China, the world’s largest importer of crude, both of which should have a significant impact on demand.