Sponsored Content

Tim Townsend, head of wealth management and corporate consulting at Alexforbes Offshore, outlines the first two of six steps to financial wellbeing

THE back end of 2021 saw the cost of living in the UK and Jersey (even more so) surge. It impacted us all. One thing became clear to us: more people needed help with their financial wellbeing than ever before, and we are well placed to do – and passionate about doing – something about it.

The Money and Pensions Service defines financial wellbeing as “feeling secure and in control. It is about making the most of our money from day to day, dealing with the unexpected, and being on track for a healthy financial future. In short: being financially resilient, confident and empowered”.

The impact of individual financial wellbeing has a far-reaching impact on communities, business and the economy. At Alexforbes Offshore, we focus on empowering both individuals and businesses as we understand how the foundation of financial health is intertwined with our individual and overall wellbeing.

Maslow identified this connection almost a century ago. We are naturally motivated to fulfil our basic (food and shelter) physiological needs first, followed by security and safety (including financial security). One can’t concentrate on a well-laid-out financial plan when hungry and cold. The reality is that when these essential needs are placed under pressure, we simply can’t dedicate our attention to moving onto more advanced needs like social belonging, self-esteem and reaching our full potential… or engaging with a financial planner to help us do this.

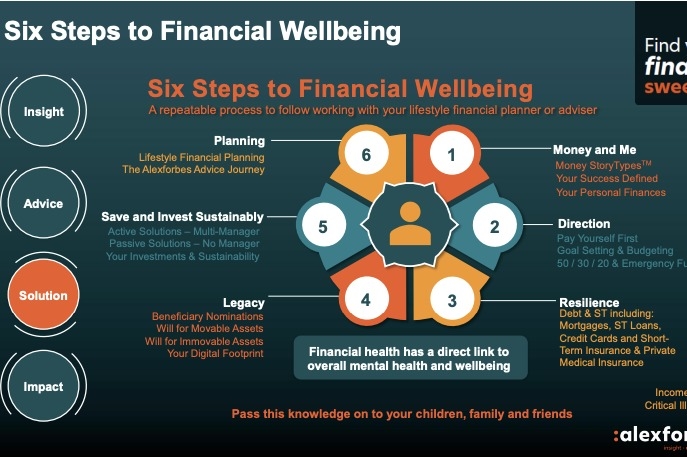

We developed a process to help our pension and employee benefits members engage with their financial wellbeing today and lead them on a path to tackling their personal financial wellbeing for tomorrow and the future. This was designed to build on the responsibility we all have to think closely about how we spend, save, borrow, invest and plan. We call it the six steps to financial wellbeing, and it is designed for anyone and everyone. We all navigate universal challenges as we navigate life. Managing our finances and providing for our futures are two of the most common shared experiences, life skills that we are yet to see hit the school curricula satisfactorily.

The first step revolves around understanding our relationship with money. If we do not understand the way we treat money and ourselves, or what influences our relationship with money, we get stuck in the same self-defeating behavioural cycles or habits. We may over-spend, over-save, procrastinate, or people-please, all to the detriment of our personal finances and wellbeing. By understanding your personal psychology of money (a title of one of my favourite books by Morgan Housel) we can start to understand more about the way we feel about money. We call this our Money Storytype® and by going to https://moneystorytypes.com/alexforbes, you can complete a few questions and receive a report which allows you access insights to reflect on what makes you tick when it comes to money.

Armed with this insight, we encourage the next step, which is focused on direction and analysing what we’re doing. Where are you going? This is the moment where we look up and see where we are, where we are heading and pause to ask ourselves whether that is what we intended or wanted in the first place. This is the skill and practice of budgeting.

It’s all about following the trail or footprint that our actions and transactions leave behind… the context of this behaviour and the overall outcome of this analysis is essentially the lifestyle we are living today. This is important, as we need to understand and connect today’s lifestyle to the one we want to lead when we retire.

The earlier we get into the habit of monitoring and controlling our spending, saving, borrowing and investing today, the better placed we will be to focus on, and design, a plan for tomorrow.

I will leave you with some homework ahead of my next piece where I bring steps three and four to life, and if you have any queries after reading this and engaging with the quiz, please do not hesitate to reach out to advice@alexforbes.je.