Sponsored Content

David Gorman, of Team Asset Management, offers this week’s market review

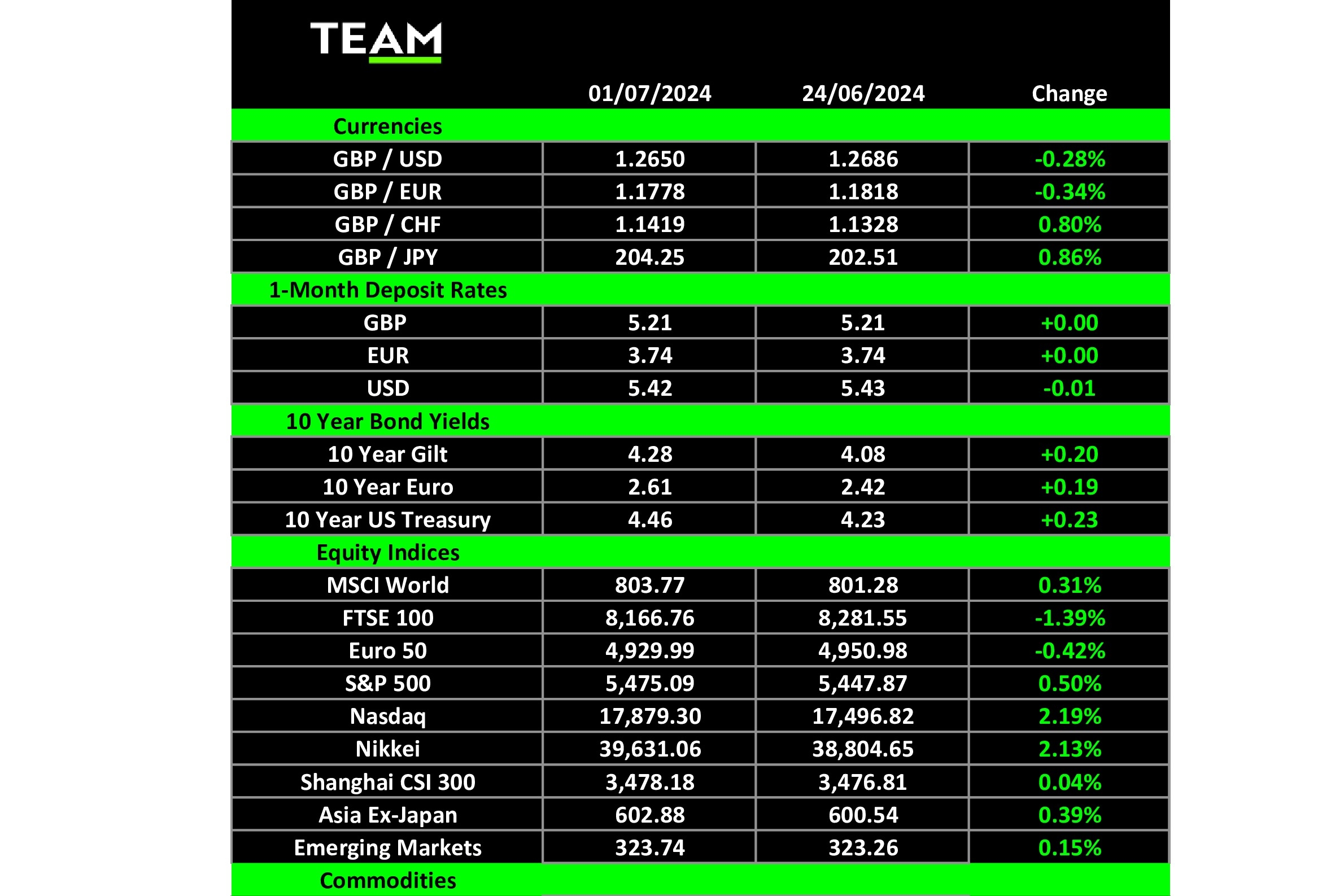

HALFWAY through the year already and markets have been dominated by US technology stocks.

The Nasdaq 100 index climbed 17%, with its main constituents linked to artificial intelligence and/or semiconductors. These areas are benefiting from the early adoption of disruptive technologies.

Elsewhere, things were not as hot, as evidenced by the French CAC 40 index, which was slightly negative over the half year. Last week was subdued but perked up a little at the end of the week when an important US inflation number came through along with the results of the first round of French voting.

The Public Expenditure Consumption Index is the US Federal Reserve’s preferred measure of inflation; in May it reached its lowest number (2.6%) for three years and the direction of travel now seems “baked in” to eventually achieve the magic 2% target.

French parliamentary election results saw Marine Le Pen and the far-right National Rally lead with around a third of the first vote. European markets have been nervous since Emmanuel Macron, the French president, announced a surprise election, fearing that the NR could achieve an overall majority.

The first-round results have been digested and now there appears to be growing support for tactical voting and candidate withdrawals in the “run-off” vote next Sunday. This is intended to restrain “hard right” majorities and create a probable hung parliament outcome. France is perceived to be the heart of Europe and an NR majority could mean the European Union would have a “heart attack”.

The fickleness of the consumer was evident this week when Nike’s fourth-quarter results showed disappointing sales and the guidance for the coming year was below expectations. Its shares fell 20% on the day, although some market observers suggest this will be the last of the poor results as it gets to grips with consumer tastes. In a similar vein, Levi Strauss also had slow sales growth and its shares reversed 16% despite promising a 1-3% sales increase for the full year. Our tastes in footwear and jeans appear to have changed.

Anecdotally, everyday conversations centre on holidays, and discussions of cruise-line vacation experiences are always high on the list. It should therefore not come as a surprise that Carnival, the world’s largest cruise liner company, should announce a 20% increase in profit guidance along with occupancy rates of 100%. Carnival shares rose 17% in response.

Closer to home, Steve Lansdown, the wealthy Channel Island resident and co-founder of Hargreaves Lansdown, has recently described that the £11bn+ private equity bid for HL as “something to consider”. However, several large holders believe the Abu Dhabi investment-company-backed bid is unfair for some shareholders and the board should explore different strategic options. Even so, the private equity consortium has until 19 July to make a formal bid or walk away.

The UK general election is tomorrow (US Independence Day), with a widely expected landslide victory for the opposition Labour party forecast.

Importantly, the result seems well discounted in UK markets, with energy and North Sea oil companies already feeling very cold draughts, given the intended Labour policies.

Finally, this Friday (1.30pm our time) we will learn again the state of play in the US labour market, with employment levels expected to gain another 185,000 jobs in the month of June. If the number should be higher, it is probable that it could upset money market predictions of the first interest rate cut in September this year. Currently, there is a near 70% probability of rates being cut by 0.25%.