Sponsored Content

Craig Farley, of Team Asset Management, offers this week’s market round-up

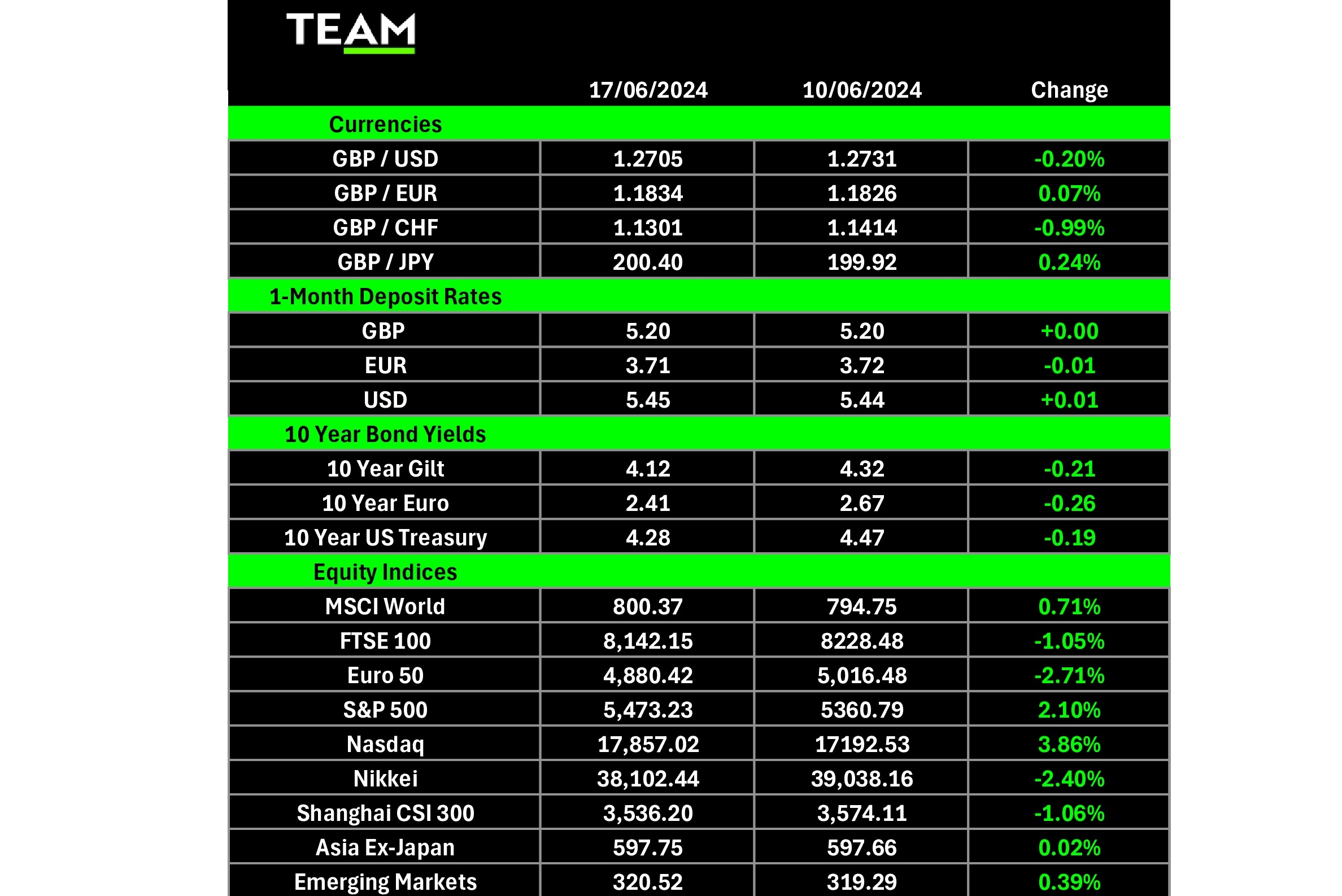

THE momentum trade across global financial markets shows no sign of slowing, with major US equity indices including the S&P 500 large cap index and the Nasdaq technology index touching new all-time highs again this week. Leadership remains highly concentrated, evidenced by the significant relative underperformance of the equal-weighted S&P 500 index (where each stock in the index is assigned the same percentage weighting, as opposed to weightings based on the market capitalisation of the company).

After a slow 2023, global equity funds are enjoying their moment in the sun, with almost $200bn of capital, or $1.7bn each day, flowing into the asset class so far this year.

The Magnificent Seven’s (Apple, Alphabet, Amazon, Meta, Microsoft, Nvidia, Tesla) share of the S&P 500 touched a new cycle high of 32%, some 12% greater than at the beginning of 2023. The three largest stocks – Apple, Microsoft and Nvidia – have all officially joined the exclusive $3trn club. Over the past 32 trading days alone, Nvidia has added more than a trillion dollars of market capitalisation, greater than the entire value of Warren Buffet’s Berkshire Hathaway, a conglomerate that has taken him six decades to build. Staggering.

Seasoned observers will note that momentum trades such as the current artificial-intelligence-driven mania can persist for a long time, but when they reverse, the impact tends to be dramatic. For now, the issue of whether AI can become a genuinely transformational technology for most businesses remains unanswered; the investing masses are convinced that a handful of mega cap companies will continue to feast on the lions share of the profits.

Meanwhile, in Europe, equity markets sold off, as the possibility of a significant breakthrough for the far-right in parliamentary elections in France (and to an extent in the UK through the Reform Party which is building a head of steam) looks to be denting market confidence.

Having been remarkably well behaved in recent years, the spread of French government ten-year bond yields (OATS) over German ten-year bond yields (bunds) has suddenly exploded, reflecting increasing concern that French President Emmanuelle Macron has committed political suicide by calling a snap general election.

Echoes of 2012 and 2017 are starting to build as a further spike in French yields will undoubtedly shift the lens of the market towards Italy and Spain, where precarious levels of outstanding government debt and a spillover effect of rising yields would make for a potent cocktail.

In corporate news, Tesla’s investors voted in favour of chief executive Elon Musk’s eye-watering compensation package amid rumblings of discontent from selective shareholders, signalling confidence in his leadership despite slumping vehicle sales and a precipitous drop in the company’s share price.

Turning to the Gulf region, foreign investors were allocated about 60% of the shares on offer in Saudi Aramco’s $11.2bn share sale. Strong appetite for an allocation was probably driven by an attractive dividend equating to a yield of approximately 6.6% according to Bloomberg estimates.

In the commodities space, brent oil bullish bets are at a ten-year low, reflecting negative sentiment on the prospect of a meaningful upward move in oil during the rest of 2024. A recent Citi report has predicted that prices could fall to as low as $60 per barrel in 2026 as the world faces “substantial surpluses” of supply that will not be mopped up by ongoing global demand. This suggests a marketplace that is complacent about a ratcheting up of geopolitical tensions and/or genuine supply disruption.

Today, the US Housing Market Index data is due to be released and the weekly unemployment claims numbers from the US Department of Labour will be announced tomorrow, two sets of information which will be closely watched for insights into how the data may influence the views of voting members of the Federal Reserve Committee.