Sponsored Content

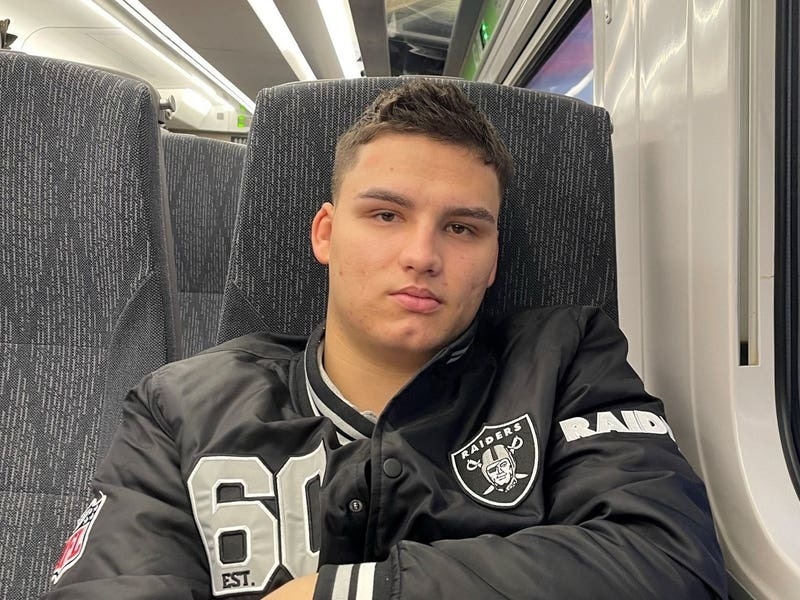

Aidan Tucker, director of Leonard Curtis Jersey, tells Julia Hunt how he went from studying plants and life science to rowing for Team GB before training as an accountant and then specialising in advisory and insolvency

LIQUIDATION and bankruptcy are usually considered unsavoury words. They evoke loss and destruction, an end to enterprise and endeavour. Restructuring and insolvency, however, are arguably different matters.

While bankruptcy is a legal declaration, made on individuals, partnerships or sole traders, insolvency is a state of financial distress which may involve a limited company, an individual, a sole trader or, in Jersey, a trust.

The use of restructuring remedies that include bankruptcy and liquidation, alongside a wide and varied range of practical actions, communication and a drive for co-operation, can result in solutions to failing or failed positions that would otherwise be considered lost.

For Aidan Tucker, insolvency is as much about finding a solution as investigating a problem. Over the past 20 years, Aidan has worked with large and mid-sized firms in the UK and Isle of Man looking for ways to help stakeholders recover assets when everything has gone wrong. In 2023 he joined Matthew Wright, founder of Leonard Curtis Guernsey, to bring Leonard Curtis to other Crown Dependencies, launching Leonard Curtis Isle of Man and Leonard Curtis Jersey.

“Leonard Curtis specialises in restructuring and liquidation,” Aidan said. “We don’t do tax, accountancy or audit but focus on solving problems, mainly around illiquid assets and distressed positions in the service space, for example, around corporate services and trusts.

“In Jersey, this might involve trusts that have run out of cash if a high-net-worth individual has stopped paying the bills, or when overseas assets have had a receiver appointed.

“We have a defined tool kit, but every situation is different. A lot of the time we go in and support directors or trustees and we have a large network of funders who are comfortable assessing the risks in this area and provide funding if needed and, in some cases, the funder may be willing to purchase the debt allowing the relevant party to exit. Overall, this can unlock the funds necessary to achieve a settlement for creditors.”

Leonard Curtis has more than 290 staff and over 30 appointment takers in the UK, with offices in London and across the UK regions, with a strong presence in the north-west where a main part of the business began.

“Leonard Curtis is a well-known firm in the UK that has grown over the years. Being part of a larger group gives the offshore businesses access to a wider network of advisers. However, we remain independent and have the flexibility to tailor our services for each individual market.”

Legislation around insolvency changed in Jersey recently through amendments to the Companies Law Act 1991 which created new insolvency solutions for Jersey companies.

“In insolvent cases, the duty of office holders is firstly to the creditors, noting certain obligations and duties remain to the stakeholders. Winding up a company through the courts is relatively new in Jersey but it gives creditors a bigger voice. It’s still taking time for the implications of the changes in legislation to filter through the industry, but it brings Jersey closer in line with many other jurisdictions which allow creditors to request the courts to wind up a structure.

“Insolvency may take many forms. In the ‘classic way’, when companies are insolvent, we use the legislation to help ensure a fair distribution of assets to creditors. We can also investigate what has happened and work with regulators. It depends on who has appointed us and for what purpose.

“However, it is a balanced and reasoned approach. As an independent party, it’s about providing a solution that is equitable for all stakeholders.”

After obtaining a degree in plant and life science at the University of Nottingham, where he rowed for Notts County and afterwards Team GB, Aidan did a post-graduation qualification in computer systems before relocating to the Isle to Man. After training as an accountant in industry and audit, Aidan moved into the “Big Four”, working in advisory and insolvency, qualifying as an insolvency practitioner under the UK Joint Insolvency Examination route. During this period, Aidan worked on multi-million-pound cases, including one with over 13,000 stakeholders that made him appreciate the human cost of what happens when things go wrong.

“It can be very frustrating for creditors when assets are there but are difficult to find, or difficult to liquidate. As an insolvency practitioner under relevant asset protection regimes, we can look back over certain timeframes and recover unlawful transactions. Even in solvent voluntary liquidations, hundreds of millions of pounds may disappear via global subsidiaries, and we have to enter into complex, cross-jurisdictional searches to get assets back.

“What we do at this level with institutional investors may seem far removed from the end creditor, but it’s important to remember who you are trying to get the best outcome for. I will always remember taking a phone call from a creditor (a nurse) who had liquidated her pension to invest in a structure that later went under. She had personally lost everything. When we ended the conversation, she said: ‘God bless you.’ She was in a terrible situation but maintained an astonishing outlook that humbled me. This is when I knew I had found my profession supporting such individuals where and when I can.”

Aidan moved to Jersey from the Isle of Man with his family to run the Jersey office, ideally growing the Island-based team to four in the medium term. Earlier this year, Aidan joined the Viscount’s List, allowing him to take court-appointed cases in Jersey, with the support of the Leonard Curtis team.

“This is going to be an interesting year as we grow our team and roll out our services in the Island. In bigger cases, such as where there are multi-million-pound losses, recovering assets can be complex but it’s generally about following the money” he said. “If liquidation becomes litigious, sometimes consolidating issues or claims can maximise returns from distressed assets. When stakeholders, creditors, directors and/or shareholder work together we can recover more assets while keeping costs down.

“While liquidation of an ‘empty cupboard’ may seem like the only outcome once insolvency issues emerge, our intervention can create opportunities, restructuring solutions and practical ideas that might not have been on the table or known about until you have spoken to us.

“If you can get to a business when it is still above the insolvency line, it may be possible to save it. We are probably able to immediately help while providing connections with turnaround experts who specialise in this space.

“However, liquidation and other formal procedures shouldn’t always be seen as negative. The former governor of the Bank of England, Mark Carney, once said words to the effect, you need a thriving restructuring market to release ‘bad’ capital from failing structures.

“A good economy needs capital to flow, and part of our job is helping turn bad capital into good capital. This can involve novel and unique ways, for example, compromise agreements, as well as asset recoveries or releases through liquidation, administration or receivership, depending upon the relevant jurisdiction.”