Sponsored Content

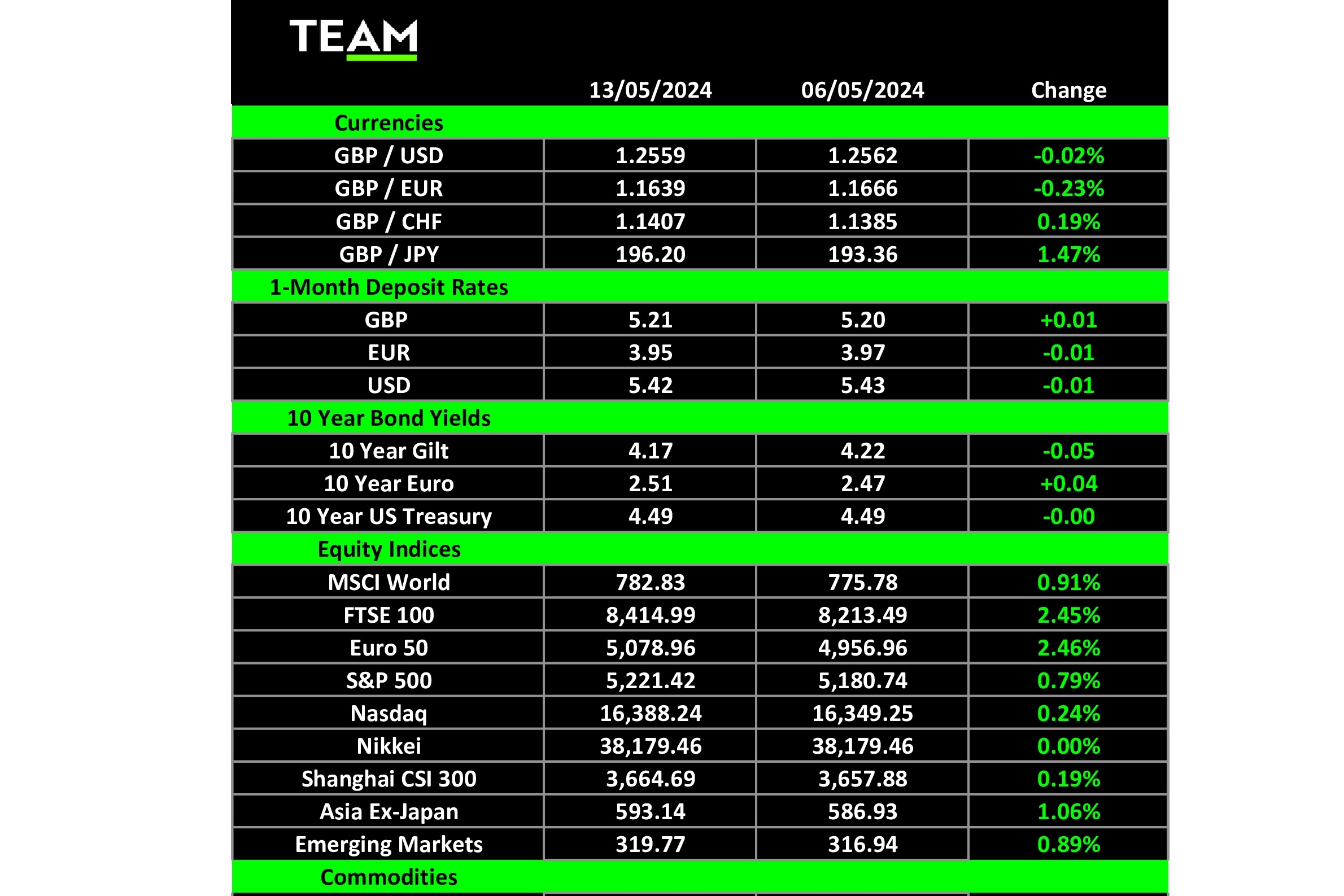

Andrew Gillham, of Team Asset Management, offers this week’s round-up of the global market

US stocks climbed to new record highs after the latest monthly inflation report from the Bureau of Labour Statistics revealed that US inflation had slowed in April, which could persuade the Federal Reserve to start cutting interest rates later this year.

The blue-chip S&P 500 and technology-focused Nasdaq indices gained 1.7% and 2.5% respectively, while the 30-stock Dow Jones Industrial Average reached the 40,000 level for the first time in its 139-year history.

Federal Reserve officials have pushed back against calls to lower interest rates as progress on bringing inflation down has faltered, but last Wednesday’s report suggested that they may be back on track.

Headline annual consumer price inflation eased to 3.4%, the first fall in three months, and the core rate, which excludes more volatile items such as food and energy, slowed to 3.6%, the lowest level since April 2021.

Money markets are now pricing in the Fed to start lowering interest rates in September, which will probably put it behind the European Central Bank and Bank of England who have both signalled that they will cut interest rates over the summer.

In corporate news, shares in BT Group jumped more than 17% on Thursday despite reporting a 31% drop in pre-tax profits to £1.2 billion in the year to the end of March because of a write-down on its struggling business division and a widening pension deficit.

However, investors chose to focus on the strategy laid out by new chief executive Allison Kirby, including a plan to cut a further £3 billion of costs over the next five years and to boost cash flow as it is now past peak capital expenditure on its rollout of full fibre broadband across the UK. The company also revealed it would increase its full-year dividend to 8p per share.

The reaction in the share price also triggered a squeeze on short sellers who had built up a record £300 million short position in BT ahead of the results announcement.

Ryanair reported that its full-year profit after tax had risen by 34% to 1.92 billion euros, and passenger numbers of 184 million were 23% higher than pre-Covid levels, but shares in the budget airline fell on Monday after it warned that airfares in the peak summer season would be softer than previously expected. Ryanair has also been affected by delivery delays at Boeing and it will be short of 23 of the new 737 Max jets this summer.

Chief executive Michael O’Leary revealed that consumer sentiment had weakened across Europe and with less than 50% of seats booked for the peak travel period, prices would probably be flat or just slightly ahead of last summer.

Looking forward, Nvidia’s earnings report, which is due to be released after trading hours this evening, will be a key focus for investors. Shares in the chipmaker have risen 91% year-to-date, after gaining more than 220% last year, and the bar is set high for it to beat analysts’ forecasts once again.

Signs of slowing inflation pushed gold prices to a new record high.

While the precious metal is regarded as an inflation hedge, the possibility of lower interest rates reduces the opportunity cost of holding an asset that does not provide a yield.

Oil prices edged higher as investors monitored developments following the death of Iran’s president Ebrahim Raisi in a helicopter crash on Sunday. Iran is OPEC’s third-largest oil producer, but most do not expect any change to its energy policy under Mohammad Mokhber, who will take over as interim president until an election is held within 50 days.