Sponsored Content

Andrew Gillham of Team Asset Management offers a weekly round-up of global markets

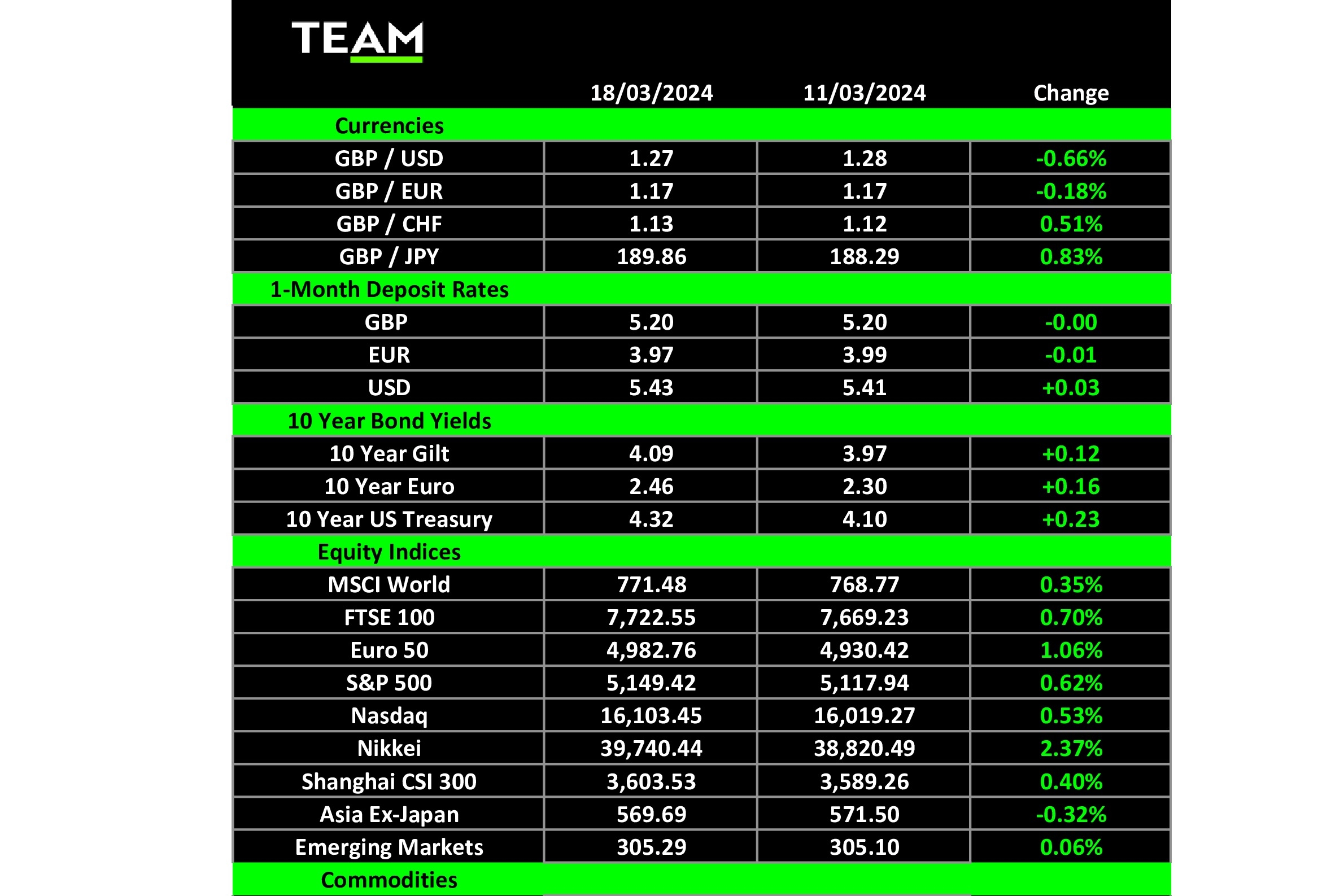

GLOBAL stocks lost some of their upwards momentum as hotter-than-anticipated inflation reports dampened expectations of interest-rate cuts ahead of key central bank meetings this week. The blue-chip S&P 500 and technology-focused Nasdaq indices gained 0.6% and 0.5% respectively.

On Tuesday it was revealed that annual US consumer price inflation had unexpectedly accelerated in February to 3.2%, moving further away from the Federal Reserve’s 2% target rate. The increase was driven by higher accommodation costs, as well as prices for services such as healthcare and motor insurance.

A couple of days later, the US Producer Price Index report for February also exceeded forecasts. Wholesale prices increased 1.6% from a year earlier, the fastest rate since September, on the back of higher fuel and food costs.

The hotter inflation reports all but rule out the possibility of the Fed cutting interest rates at this week’s FOMC meeting. Money market futures are now pricing in less than a 1% chance of a rate cut and have pushed out expectations of a first cut to at least June.

The Bank of England’s Monetary Policy Committee will announce its interest-rate decision tomorrow lunchtime and, similarly, no change is expected. The UK has higher inflation than in other developed economies and wage pressures suggest the BoE has a tougher battle than its peers. Excluding bonuses, average earnings grew at an annual rate of 6.1% in the three months to December.

In company news, shares in Adobe fell almost 14% on Friday after it reported its first-quarter results after hours on Thursday. While its earnings beat forecasts, investors were unnerved by its subdued forward revenue guidance and several analysts cut their price targets for Adobe shares.

The software design company warned that increased competition regarding its artificial intelligence products would weigh on earnings and that second-quarter revenue would probably fall a bit short of its previous guidance of $5.31 billion. Its announcement that it would buy back $25 billion of stock did little to improve sentiment on the day.

Shares in Scottish Mortgage Investment Trust rose more than 5% on Friday after it announced it would buy back £1 billion of stock over the next two years. The board of the FTSE 100 company approved the largest-ever buyback by an investment trust in a bid to narrow the 15% discount at which its shares were trading compared to its net asset value.

Boosted by exposure to tech companies such as Amazon, Nvidia and Tesla, shares in the trust traded at a premium above NAV through much of pandemic but its holdings of private, unquoted companies has attracted some criticism from investors more recently.

Shares in Google’s parent company, Alphabet, jumped 5% on Monday following reports that it is in talks with Apple to licence its Gemini artificial intelligence technology to power some new features on the iPhone. The two companies already have a history of working together, with Alphabet paying Apple billions of dollars each year for Google to be the default search engine in the Safari web browser.

There were contrasting fortunes for industrial metals last week. Copper climbed to an 11-month high of more than $9,000 a tonne on the London Metal Exchange after Chinese smelters, which process half of the world’s mined copper, agreed to cut production at facilities which are no longer profitable.

Iron ore, on the other hand, fell below $100 a tonne for the first time since May, extending its decline to more than 26% so far this year. The slump reflects concerns over demand from China where its steel-intensive property sector is in crisis. Policymakers in Beijing have also resisted calls to ramp up spending on new infrastructure projects as it has in the past to stimulate the economy.

In energy markets, brent crude rose to a four-month high of $86 a barrel following Ukrainian drone strikes on Russian oil refineries. In its latest report, the International Energy Agency also forecasts the oil market will be in a “slight deficit” this year, a U-turn from its earlier prediction of a “substantial surplus”. It cited the production cuts made by members of the Opec+ cartel to support prices and global consumption rising to 103 million barrels a day.