Sponsored Content

David Gorman, of Team Asset Management, offers this week’s market review, which included a record close

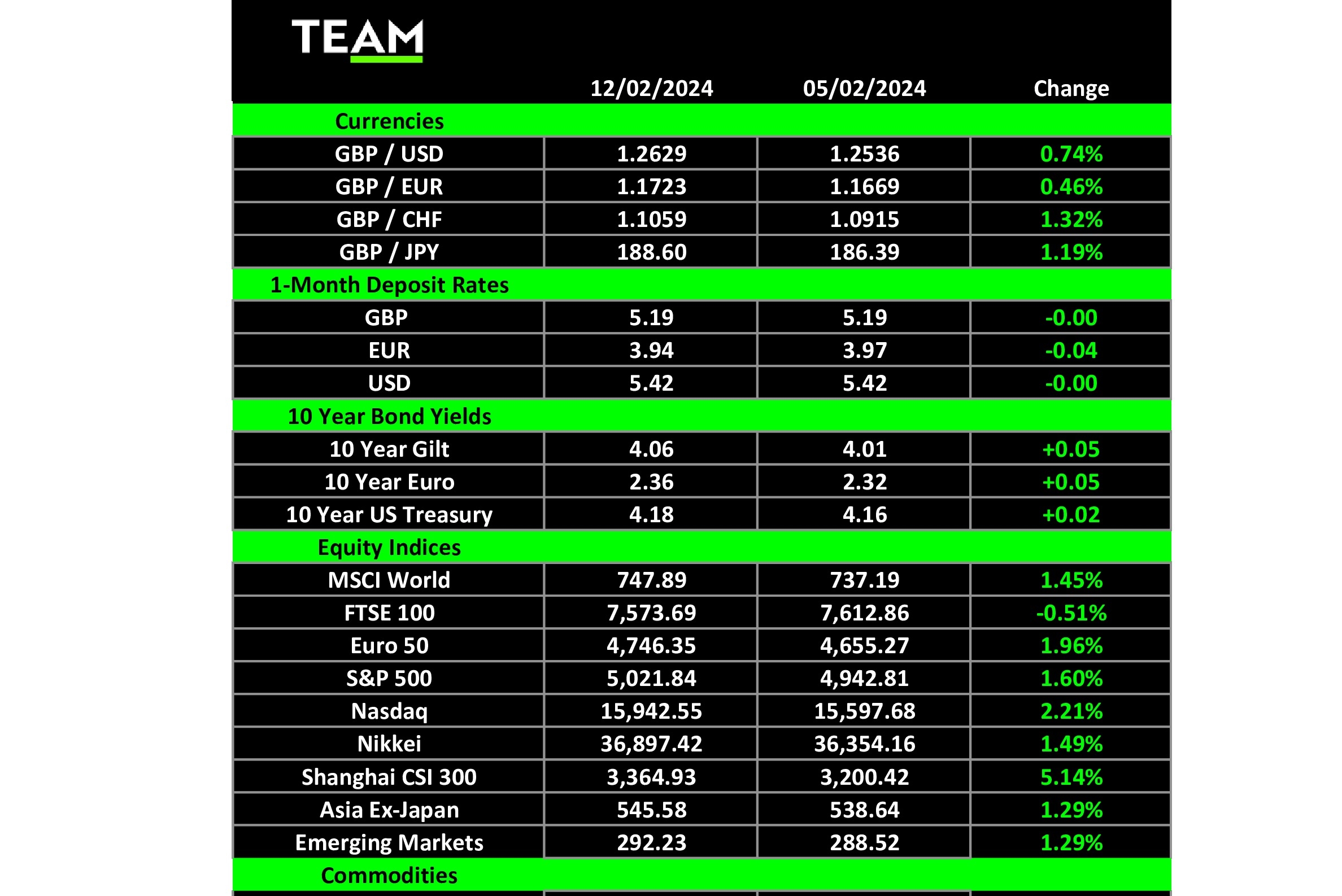

THE main American index, the S&P500, reached a record close of over 5,000 last Friday. Yet again, strong performances from the technology sector led the charge and sentiment improved as company announcements of share buybacks increased by 10% compared with this time last year.

It suggests corporates are happier with the state of the economy and expect share prices to rise further this year. We also saw the Atlanta Fed Survey estimating extremely healthy economic growth in the US of 3.4% (up from 3% last month) in the first quarter of 2024.

The technology sector makes up a third of the index – a level not seen since the good old days of the “dot com” era. Who can forget the days of “hope” between 1998 and 2000 and the extraordinary valuations placed on companies that never ever turned a profit? Comparisons are plentiful but today high valuations are arguably deserved given the exceptional profitability and cash generation of many technology companies. Therefore, do not expect the same “crash” in prices that we witnessed among technology news in 2000-03.

Turning to company news, Expedia, the American travel technology company, saw its shares fall by a fifth as news of the sudden departure of its chief executive hit the tapes. It came with a warning about the effect of falling air ticket prices and the grounding of Boeing 737 Max 9 Fleet on its revenues.

For those interested in French companies, Hermes, the luxury goods company best known for its Birkin bags, announced that its fourth-quarter 2023 sales had risen by 17.5% whereas L’Oreal, the cosmetics company, could only muster a 2.5% sales rise in the same period. The results and the stock market impact were clear as Hermes overtook L’Oreal to be the second-largest-valued French company behind LVMH (Louis Vuitton).

Investors should take note tomorrow when we see the first estimate of UK economic growth for the fourth quarter of 2023. The expected outcome is a marginal decline in activity of 0.1%, which, if confirmed, would be the second consecutive quarter of negative growth – a technical recession.

However, forecasts are just that and the fact that households and businesses are feeling relief from falling energy prices, lower inflation and real-worker pay increases may just be enough to avoid a shallow UK recession.

Any bad economic news could place added pressure on the Bank of England to make early cuts in interest rates – at their next meeting in late March? It is best not to hold your breath on this happening given the recent dismissive rhetoric from Threadneedle Street.

On Friday, it is the start of the UK bank results season with NatWest reporting its 2023 outcome. Profits across the major UK banks are set to rise sharply thanks to the impact of higher interest rates.

Could these results be the springboard for Chancellor Jeremy Hunt to make good his intention to sell the government’s 38.6% stake in NatWest to retail investors? He did suggest that this could take place in 2024 but indicated that it could take until 2025/26 to fully privatise the group. HSBC, Lloyds and Barclays announce their results next week.

Finally, President Joe Biden suffered “the worst day of his presidency” after a bombshell report found the US President had “significant limitations in his memory”. Lawyers who interviewed Mr Biden as part of an investigation into his handling of classified documents said he could not remember when he was vice-president or when his son died of brain cancer. This headline would “confirm every doubt and concern” voters have about Mr Biden.

His current 12-point gap in the latest opinion polls behind probable Republican presidential nominee Donald Trump, and the possibility of a change of leadership, will give investors something else to think about as we move closer to the November 2024 election.