Sponsored Content

David Gorman, of Team Asset Management, offers this week’s market round-up

IN common with our own weather, financial markets have started 2024 with a distinct change to icy conditions.

The momentum with which stocks built up in the last two months of 2023 has proved unsustainable as the market takes a more sober view of the prospect of multiple interest-rate cuts this year and the uncertainty over a “soft landing” for the US economy.

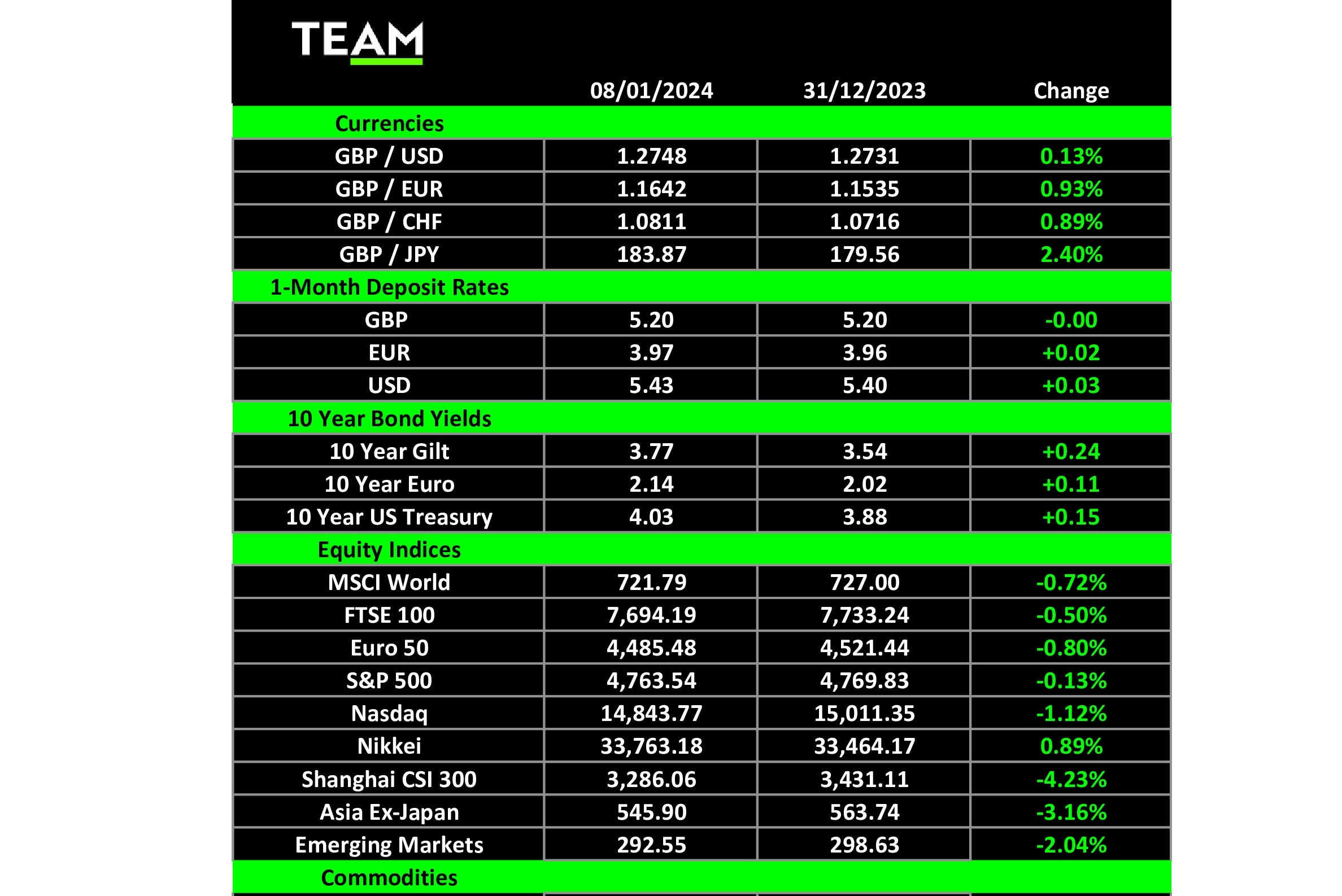

The blue-chip S&P 500 and technology-focused Nasdaq indices fell 0.1% and 1.1% respectively.

Importantly, US job numbers for December were again much stronger than expected, suggesting that the economy is still proving resilient and therefore the Federal Reserve will not need to cut rates as quickly as implied by future money market projections.

For instance, last month the probability of a US rate cut in March this year was close to 90% but today it has fallen to 64% and is headed even lower.

A similar picture is evident in Europe. After six months of declining inflation, Eurozone inflation rose to 2.9% on an annualised basis to December last year.

This was higher than the previous month, which was just 2.4%. The increase is because of the removal of government energy subsidies.

Food price inflation is still 6.1% but markedly lower than November’s number of 6.9%.

More encouragingly, the core rate of inflation (excluding food and energy at 3.6%) fell to 3.4%, giving some credibility to the six implied rate cuts expected in 2024 by the European Central Bank.

The domestic inflation figures for both Germany and France were not as good as the general Eurozone, so the ECB will remain cautious about moving rates down too early when resolution of key wage negotiations in the next two months are outstanding.

Higher wage agreements are likely to restrain prompt action on interest rates until the 2% inflation target is secure.

Perhaps we should rely on what consumers are thinking for the best guide.

The New York Survey of Consumer Expectations showed one-year inflation expectations are now down to 3.4% and, in three years, that drops to 2.6%.

Unemployment expectations are also down, signifying that people are more optimistic about keeping their jobs, while household spending is expected to be above inflation levels.

Overall, it is saying we can look forward to lower inflation and an economy unlikely to go into recession.

In corporate news, American aircraft manufacturer Boeing was in the news for the wrong reasons. The Federal Aviation Authority ordered airlines to ground more than 170 Boeing 737 Max 9 planes for inspection after an Alaska Air model suffered a “blow-out” of a window, forcing it to make an emergency landing. Investors are sensing that this stemmed from a manufacturing error rather than a design flaw.

Nonetheless, the shares in response are down 11% in two days because of the worry that medium-term planned monthly production ramp-ups of the 737 Max 9 aircraft can be achieved.

Closer to home, Marks and Spencer food has been the “standout” in the high street at Christmas. In the four weeks to Christmas Eve, grocery sales rose by 14.2% compared with the previous year.

Other retailers saw significantly lower sales growth, so the market has correctly discounted its re-emergence, with the shares more than doubling in value during 2023.

In the coming week, tomorrow will see the release of the December US Consumer Price Index (inflation), which can traditionally move market sentiment. On Friday, the major US banks, including JPMorgan and Bank of America, kick off that start of the fourth quarter corporate earnings reporting season.