Sponsored Content

Andrew Gillham, of Team Asset Management, presents the firm’s weekly round-up of global markets

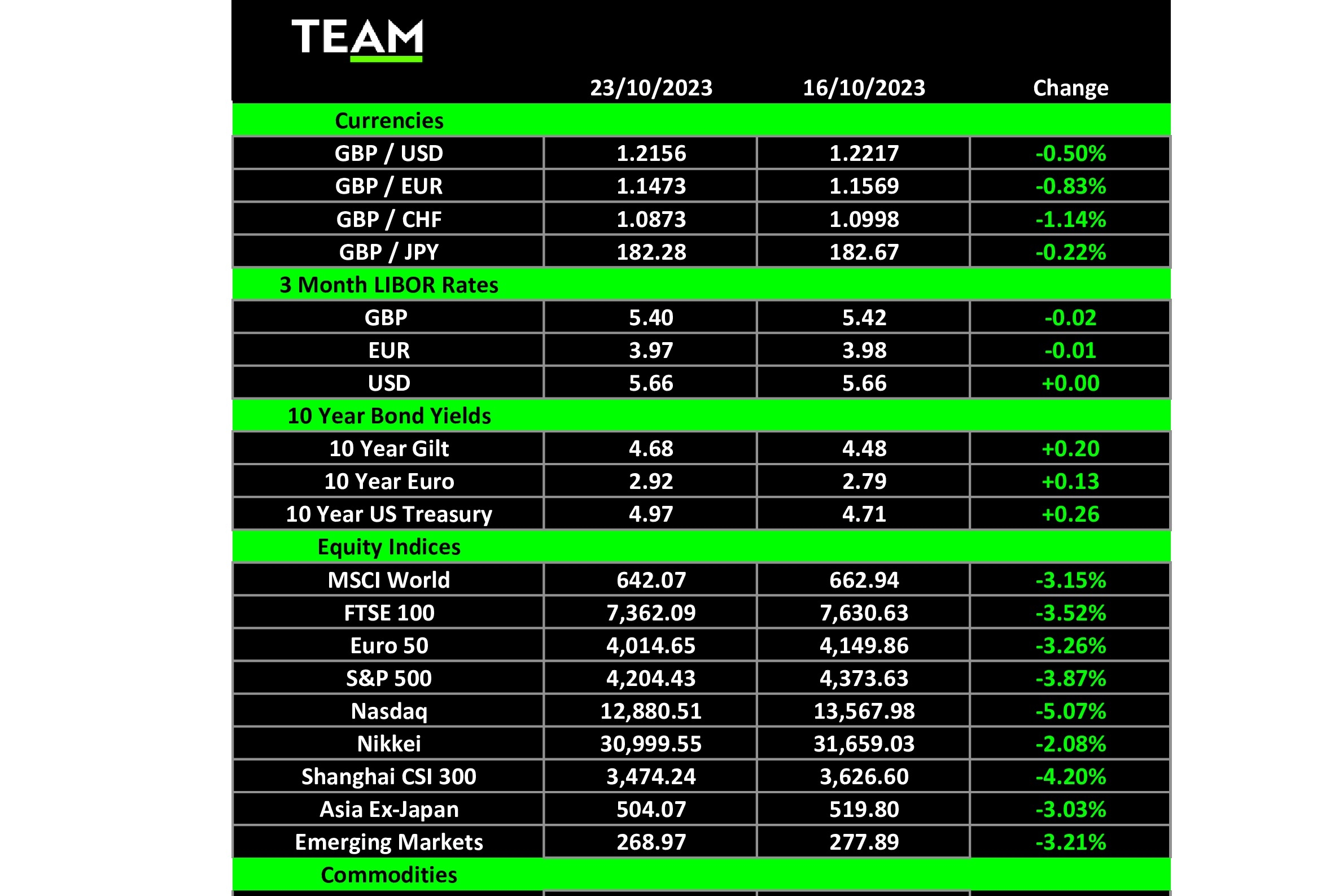

GLOBAL stocks moved sharply lower last week as stronger than expected economic data suggested monetary policy was not restrictive enough and that central banks might need to raise interest rates further to tame inflation. Ten-year US Treasury yields briefly climbed above 5% for the first time since 2007.

US Treasuries, and other government bonds, typically attract safe-haven inflows amid heightened geopolitical tensions but, while the Israel-Hamas conflict has shaken sentiment, investors have instead sought sanctuary elsewhere in cash and precious metals such as gold and silver. The gold price has risen to $1,980 per ounce, an 8% gain since the start of the conflict.

The US consumer shows little sign of slowing down in the face of higher interest rates and inflation. Retail sales grew 0.7% in September from the previous month, the sixth consecutive monthly increase. Consumer spending is the backbone of the US economy, accounting for more than two-thirds of GDP, and the data points to another positive quarter. The Atlanta Fed’s GNPNow Model estimates that the economy will expand at an annualised 5.4% in the third quarter.

In the UK, it was revealed that the headline annual consumer price held steady at 6.7% in September, versus forecasts of a small drop to 6.6%. The core inflation rate, which excludes more volatile food and energy prices, however, eased slightly to 6.1%.

The Bank of England’s efforts to bring inflation down to its 2% target rate have been made more difficult by the strength of the labour market. Wages, excluding bonuses, in the UK grew at an annualised pace of 7.8% in the three months to August, outstripping inflation and just shy of the record increase. The BoE, however, expects that steadily rising unemployment will reduce upward pressure on wages over time.

It was also be a busy week for corporate news as companies reported third-quarter earnings.

Shares in Adidas rose more than 3% on Wednesday after it revised down its expected operating loss for the year to 100 million euros. Earlier in the year, the German sportswear giant warned that the termination of its relationship with Kanye West and impairments on its unsold Yeezy inventory would result in a 700-million-euro loss for the year.

However, it generated another 150 million euros from selling a second batch of Yeezy shoes in the third quarter and the book value of its remaining inventory has fallen to 300 million euros.

Netflix was another winner and its shares jumped 16% on Thursday after it reported that it had added 8.8 million subscribers during the quarter, the biggest gain in more than two years and well ahead of analyst forecasts of around 5.5 million.

The video streaming platform’s launch of a cheaper ad-free plan has been a success, accounting for around 30% of new sign-ups in the countries where it is available, as has its crackdown on sharing passwords across multiple users. It has also added older shows on licence from rival studios, including the legal drama Suits, which has generated a record one billion viewing hours on the platform over the summer.

In contrast, Tesla’s earnings report was received much less well by investors and its shares fell 17% between Wednesday and Friday, wiping $136 billion off its market capitalisation.

The electric-car manufacturer reported net income of $1.85 billion for the quarter, 44% less than in the same period last year, and chief executive Elon Musk admitted he was worried about the impact of high interest rates on demand for new cars and the wellbeing of key markets, China and Europe. He also warned that he expected it to take 12 to 18 months for Tesla’s next electric pick-up, the Cybertruck, to become a positive cashflow contributor.

Energy markets rose for a second straight week over concerns that the Israel-Hamas conflict might draw in other countries and disrupt supplies of oil and gas from the region. Around one-fifth of the world’s oil and one-third of seaborne gas shipments transit through the Strait of Hormuz in the Gulf.