Sponsored Content

Team Asset Management offer their weekly review of the global markets

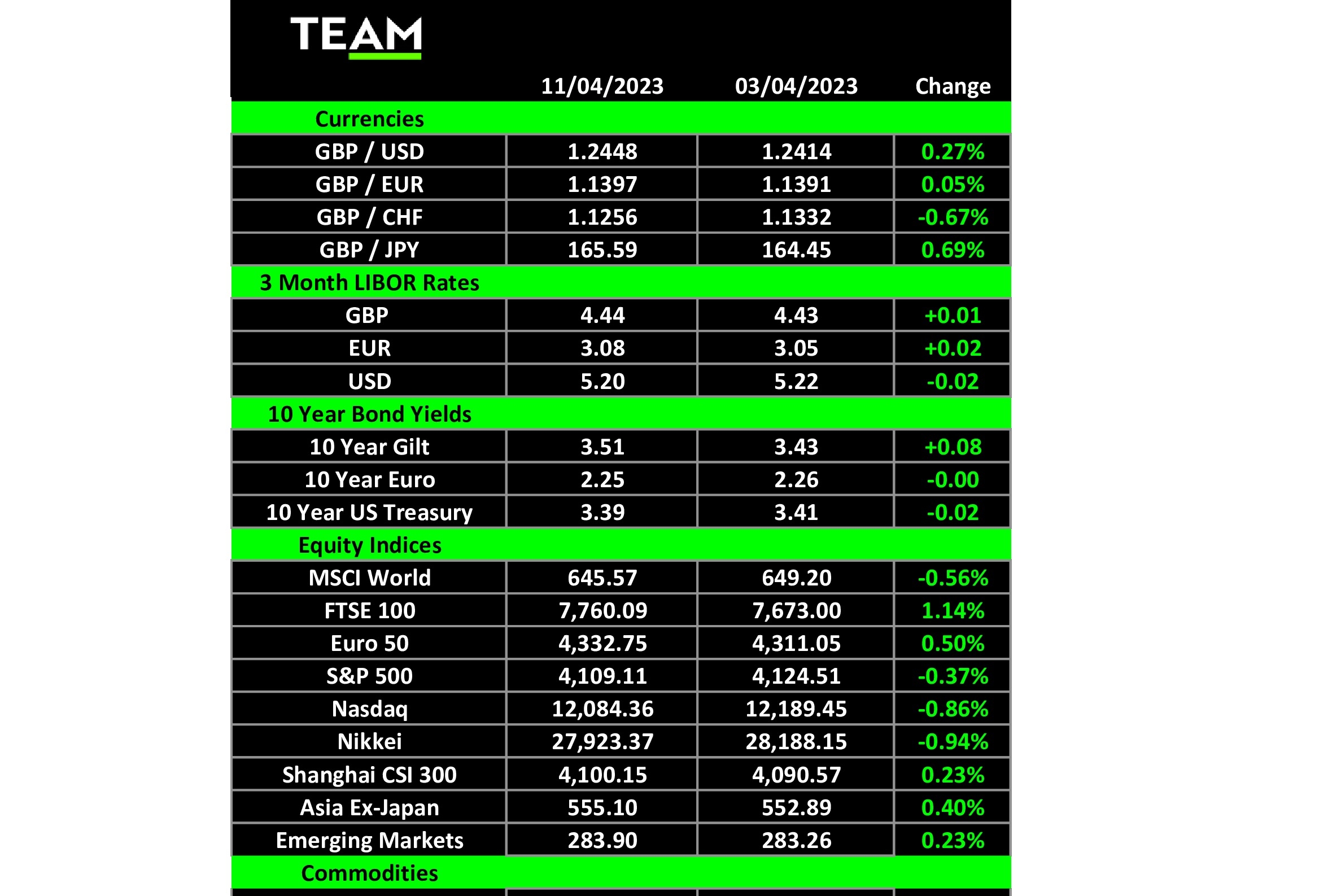

THE markets have been flat over the past week, which has provided much-needed respite from the recent volatility.

We saw reduced volume across the board owing to the bank-holiday weekend and this, coupled with a quiet macro calendar, ensured that investors could enjoy their Easter. The S&P 500 finished the week minus 0.10%, comfortably below a strong FTSE100, which saw gains of 1.43%. Following the explosive changes in the prior week, this consolidation among most asset classes was warmly welcomed ahead of this week’s Federal Open Market Committee meeting.

Global investors continue to digest the paths of monetary policy, with equities seeming to favourably price in the possibility that most central banks have almost peaked or have already finished their interest-rate hikes. Fortunately, US regional banks enjoyed another week without any major incidents, which restored investor confidence as concerns continue to linger regarding the consequences of the record rate increases. News has remained quiet surrounding the UBS takeover of Credit Suisse, which will take considerable time for the Swiss giant to process and on board.

Although markets were closed on Friday, the United States saw its payroll and unemployment numbers – which remain a key focus for Federal Reserve chair Jerome Powell – released. Non-farm payrolls came in slightly lower than expected at £236K, the lowest since December 2020, and the unemployment rate ticked back down to just 3.5%.

Both figures continue to reinforce the fact that the labour market remains resilient amid elevated levels of inflation and macroeconomic headwinds. Inflation figures this week will be a crucial guide in the ongoing battle for price stability and the direction of the US dollar and market yields.

Following on from last week’s OPEC+ decision to cut production of oil by 1.2 million barrels a day, brent crude prices were stable throughout the week, hovering around the $84 a barrel mark. The elevation in prices remains a concern for inflation levels of which energy is such a large component. It is even more annoying for the US which failed to replenish its strategic petroleum reserves while prices were much lower. This led to market participants postulating that the OPEC move was purely tactical.

Gold and Silver continued to make impressive gains with the former managing to surge past and hold the $2,000 mark as investors continue to pile into the safe-haven asset. The latter also made gains reaching $25 again for the first time since April last year and is now up a spectacular 25% in just over a month.

Speaking of impressive gains, cryptocurrencies also shot up towards the end of the week, with Bitcoin leading the charge and surpassing 80% year to date. The highly speculative asset class has continued to defy the gravity of quantitative tapering this year and leaves many debating the driving force behind its performance.

As we head towards another quarterly corporate results season, investors will be nervously anticipating what lies around the corner, especially for the big banks. They will be under scrutiny as the banking fallout will be noted in their numbers. Be prepared to learn of profit warnings and earnings revisions as companies grapple with the tough economic landscape.