Sponsored Content

Andrew Gillham of Team Asset Management offers this week’s market review

THE post-US election rally ran on into last week, pushing American stocks to new all-time highs.

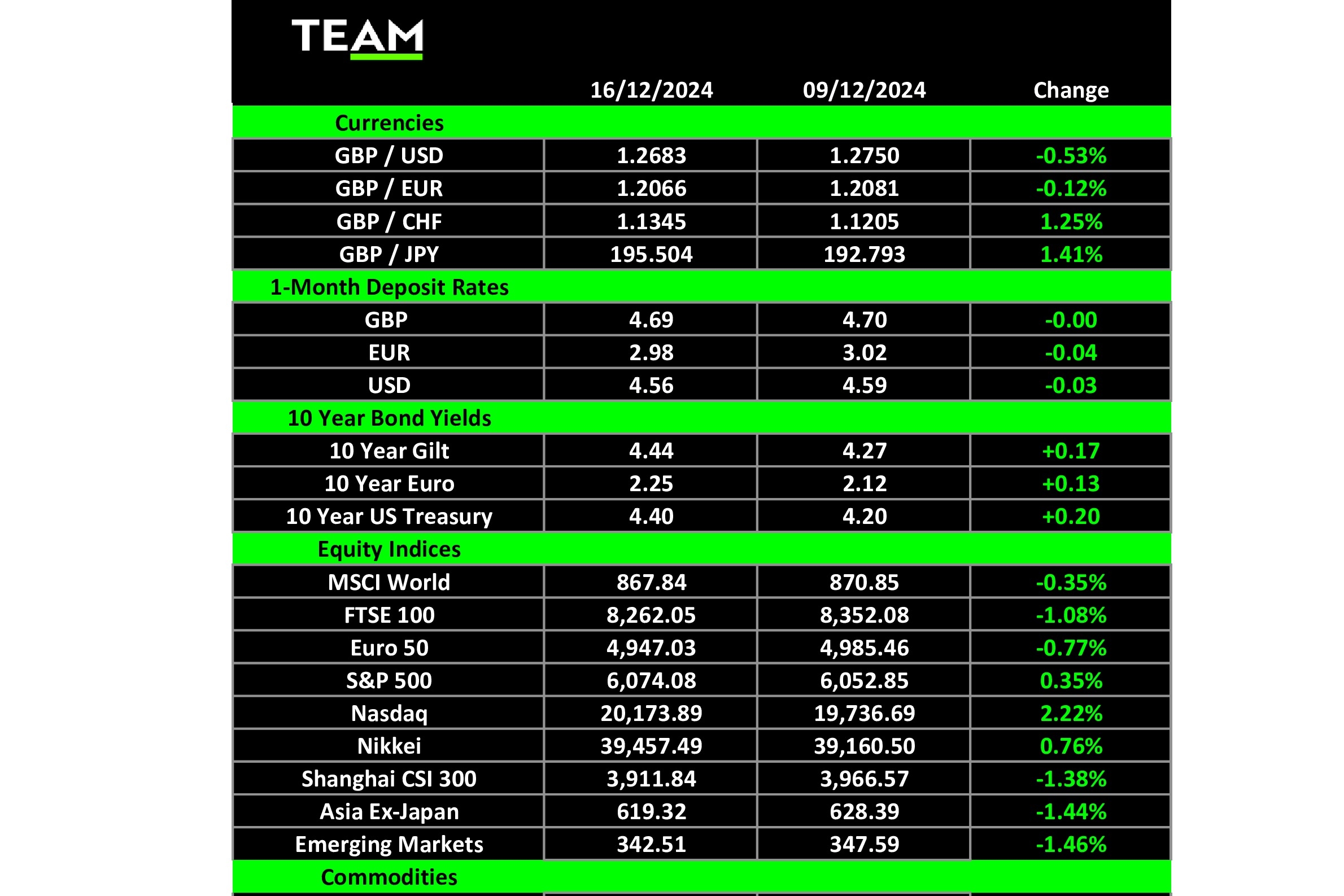

The blue-chip S&P500 and technology-focused Nasdaq indices gained 0.4% and 2.2% respectively with investors banking on the President-elect’s pro-business agenda, including tax cuts and sweeping deregulation, to provide more tailwinds for companies’ earnings. On the other hand, stocks in the UK and Europe, where the economic outlooks are more challenging, traded lower.

The close association between Donald Trump and the markets was underscored by his attendance at the New York Stock Exchange to ring the opening bell on Thursday. Flanked by vice-president-elect JD Vance and incoming First Lady Melania Trump, an enthusiastic trading floor broke into chants of “U-S-A, U-S-A”.

Supporters of the President-elect are also in a celebratory mood, none more so than Elon Musk who became the first person to eclipse $400 billion in net worth last week. Shares in electric vehicle manufacturer Tesla, which make up the bulk of his wealth, have risen 90% to an all-time high since the 5 November election and an insider share sale of privately held SpaceX added another $50 billion to his fortune.

Shares in Google’s parent company, Alphabet, also hit a record high last week after it unveiled its Willow quantum computing chip. The chip has been hailed as revolutionary by some experts, as it can solve highly complex computations in minutes in contrast to the world’s fastest supercomputers, which would take millennia to compute.

While it may take up to five years to see the chip being used in real-world applications, Alphabet is already partnering with companies in the pharmaceutical, material science and battery space to develop the technology.

Another record breaker is Bitcoin, which has traded above $107,000 for the first time. The world’s largest cryptocurrency, with a total market valuation of $2.1 trillion, has risen 60% since November’s elections and the incoming President added more fuel to the rally over the weekend when he suggested that the US would create a bitcoin strategic reserve similar to its oil reserve.

Russian lawmakers are also thought to be working towards creating a Bitcoin strategic reserve after President Putin praised utility of the cryptocurrency as an alternative to foreign currency reserves, much of which have been seized by Western governments in response to Russia’s invasion of Ukraine.

It wasn’t, however, such a good week for France, which saw its credit rating downgraded to Aa3 by Moody’s following months of political turmoil which has prevented its government from making any meaningful steps to tackle its budget deficit.

Former Prime Minister Michel Barnier’s minority government was toppled earlier this month in a no-confidence vote after opposition parties rejected his plans to cut spending and raise taxes, and new Prime Minister Francois Bayou faces a similarly daunting task.

France’s budget deficit is the second-highest in the Eurozone and Moody’s forecasts it will increase to 6.3% of GDP next year, more than double the European Commission’s borrowing limit of 3% of GDP.

On Friday, Bayou used his acceptance speech to affirm that tackling the debt burden will be his priority, mindful that France’s debt interest costs have already risen above what the government spends each year on defence and education.

In commodities markets, brent crude climbed $2 to $74 a barrel amid concerns of supply disruptions as tensions in the Middle East flared up in the wake of the ousting of President Bashar al-Assad from Syria. The demand outlook was also given a boost by authorities in China, the world’s largest buyer of crude, indicating that they will push through more stimulus measures next year to spur domestic economic growth.