Sponsored Content

Lloyd Adams, of Team Asset Management, offers this week’s global markets review

The US economy continues to defy the naysayers, showing impressive resilience in the latest jobs data, with manufacturing activity surpassing expectations for the first time in months, offering more evidence of sustainable growth. US job creation bounced back strongly, with payrolls rising by over 220,000 as disruptions from storms and strikes eased. Key sectors such as healthcare and leisure led the gains, while retail struggled, shedding 30,000 roles ahead of the festive season. The percentage of unemployed did rise a touch, which has bolstered market expectations of a US Federal Reserve rate cut on 18 December.

Across the Pacific, China’s economic challenges paint a more sobering picture. Its central bank is preparing the largest interest rate cuts in a decade, with a 0.4% reduction in its policy rate widely anticipated. Additional measures, such as easing reserve requirements for banks, aim to combat deflation and revive growth in a faltering property market. China has also escalated trade tensions with the US by banning exports of gallium, germanium, and antimony – key minerals with military and technological uses. Gallium and germanium are crucial for semiconductors, infrared tech, fibre optics and solar cells, while antimony is used in ammunition and other weaponry. The negotiation tactics ahead of the Trump administration seem to be becoming clearer.

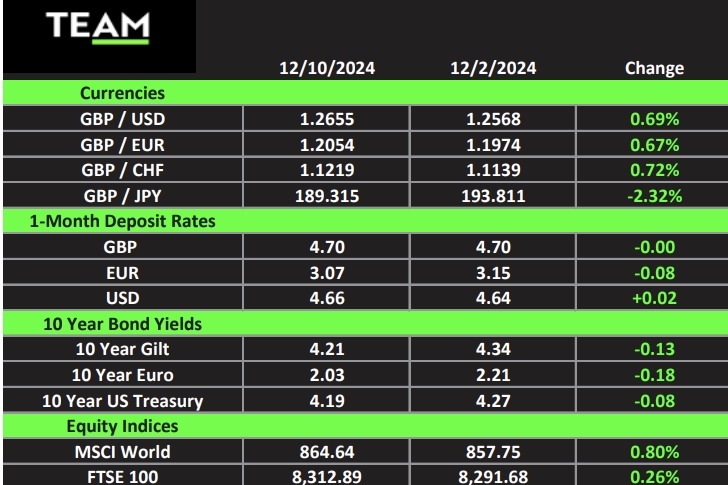

Closer to home, the Bank of England has signalled a shift towards easing, albeit cautiously. Governor Andrew Bailey has hinted at multiple rate cuts in 2024, provided inflation continues its downward trend. While recent data shows inflation cooling faster than anticipated, the Bank remains wary of acting too aggressively. Restoring rates to a more neutral level, without reigniting price pressures, will be a delicate balancing act.

Meanwhile, Europe’s largest economies are facing distinct pressures. Germany, long regarded as the powerhouse of the Eurozone, is struggling to maintain its footing. Declining exports, particularly to China, have hit its manufacturing sector hard, with ripple effects being felt by neighbouring countries that rely on German industry. France, too, is mired in uncertainty. A dramatic no-confidence vote has brought down Prime Minister Michel Barnier’s minority government, leaving the country without a budget, and facing growing deficits. The political turmoil has unsettled investors and could lead to higher borrowing costs in the months ahead.

Amid these global uncertainties, one story stands out for its unexpected optimism: Bitcoin’s dramatic rise. The cryptocurrency has surged past the $100,000 mark for the first time, propelled by significant regulatory and political shifts. The approval of Bitcoin exchange-traded funds has unlocked institutional investment from giants like BlackRock and Fidelity, injecting billions into the market. Adding to the bullish sentiment, Donald Trump’s return to the White House has sparked hopes for a more crypto-friendly regulatory environment.

Turning to individual winners in the markets, DocuSign (+34%), the e-signature and digital contract platform, impressed investors with strong quarterly results and increased customer activity. Watches of Switzerland (+20%), a luxury watch retailer, impressed with better-than-expected sales, particularly in the US, and held firm on its annual forecasts. In contrast, Intel plunged (-13%). The sudden removal of chief executive Pat Gelsinger has left the chipmaker in limbo, casting doubt on its recovery plans and future direction. St James’s Place, the asset manager, declined 5% as it announced plans to cut around 500 jobs as part of a £200m cost-saving initiative.

Looking to commodities, oil prices did not respond meaningfully to the Organisation of Petroleum Exporting Countries’ decision to delay production increases until April next year. Copper prices got a boost from signs of improved manufacturing activity in China; however, fears of a renewed US-China trade war under Trump add uncertainty. Gold prices also remain steady.

This week is dominated by key central bank decisions, with many focused on interest rate cuts. The Reserve Bank of Australia is scheduled to meet on Tuesday, followed by the Bank of Canada and the US Fed on Wednesday, and the European Central Bank on Thursday.