Sponsored Content

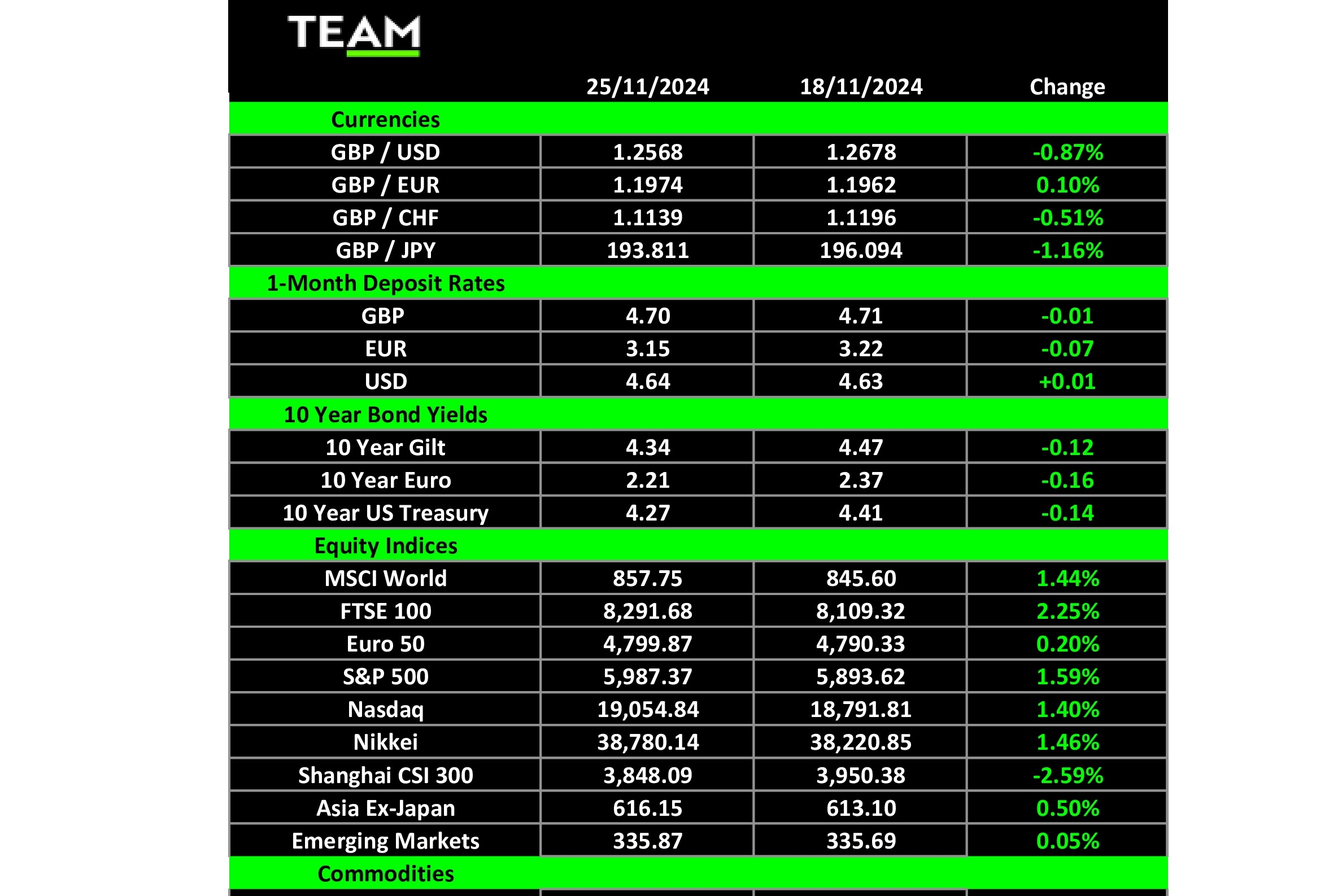

Harry Brassington, of Team Asset Management, offers this week’s global markets review

After weeks of uncertainty and controversial cabinet picks for the Trump presidency version 2.0, a sense of calm has been ushered in with the nomination of Wall Street hedge fund titan Scott Bessent for US Treasury Secretary.

With the other nominations raising more than a few eyebrows, Trump’s picks are a clear signal to shake up the establishment and, in his words, “drain the swamp”. Mr Bessent is far from anti-establishment, a veteran of America’s, and the world’s, biggest and most important establishment, Wall Street.

At the heart of “America First” is the Donald’s shock-and-awe tariff plans, which he is seemingly keen to implement upon taking office in the new year. However, the prevailing sense among investors is that an aggressive approach would probably spook markets.

Although Mr Bessent is a strong advocate of Trump’s America First agenda, he is seen as a more measured character than many in Trump’s inner circle. As such, markets are hoping that the noise around Trump’s initial tariff plans is simply that – posturing to bring external parties to the negotiating table.

Away from political headlines in the US, major equity markets continue to grind higher, underpinned by large inflows into US ETFs, as retail investors rush to join the Trump trade party. Economic data released during the week continues to point to a resilient American consumer, while the jobs and inflation data has forced a rethink on rate expectations for 2025.

Just a few weeks ago, money markets were pricing 200 basis points of cuts from the Federal Reserve in a 15-month window. As it stands, expectations have been reined in by a full percentage point to just two or three cuts by the end of next year.

In corporate news, all eyes were on Nvidia chief executive Jensen Huang as he delivered the latest earnings results for the AI poster child of this post-pandemic cycle. The quarterly release has become as, if not more, significant for markets than many macro events. Incredibly optimistic revenue and margin targets were achieved, although some disappointment was articulated over guidance and the next generation Blackwell chip.

The inflation story continues to be the focus closer to home. Last week saw a spike in inflation driven by higher energy bills. Higher inflation pushes up costs for households and is likely to create a headache for government, which desperately needs to reinvigorate economic activity.

The Bank of England have signalled a desire to bring interest rates down to a less restrictive level. However, it has emphasised this must be done gradually, as persistent areas of inflation remain a concern for the central bank. Inflationary pressure has only been ramped up by the Labour parties’ policies to increase the minimum wage, introduce tax hikes on businesses and (expand?) workers’ rights.

Another central-bank headache was the news of higher-than-expected UK government borrowing costs driven by public sector pay awards. Defined by the difference between spending and tax intake, the government borrowing figure stood at £17.4bn, the second highest it’s been since records began in 1993.

The embattled Chancellor will have tough questions to answer about how the much-criticised Budget will be able to deliver the growth she has promised. Last week she received a warning that high-street job losses were inevitable in a letter signed by some of the retail industry’s biggest names, including Amazon, Tesco and Greggs.

This is the first time retailers have collectively spoken out citing the cumulative effect of a higher minimum wage, while increases in national insurance contributions would add an additional £7bn in costs to the sector. The policy stance has dented business confidence making it harder to consider additional hires and undermining investment.

The nation’s most famous farmer, Jeremy Clarkson, attended a protest in London as thousands of farmers descended on the capital in their tractors over changes to inheritance tax rules. Mr Clarkson’s Amazon show, while entertaining, has highlighted the difficulties faced by British farmers. The latest policy will see farms’ assets subject to 20% IHT. In an industry that is notably asset rich yet cash poor, this news has come as a major blow to farmers, who are already experiencing higher cost since Brexit and high prices since the Russian invasion of Ukraine, which disrupted supply chains.

In a final piece of news, Bitcoin hit a record high. Last week I wrote about Bitcoin Pizza Day, when two pizzas were bought for 10,000 Bitcoin in 2010. At the time this was the equivalent of $41; this week the pizzas nearly hit $1bn.