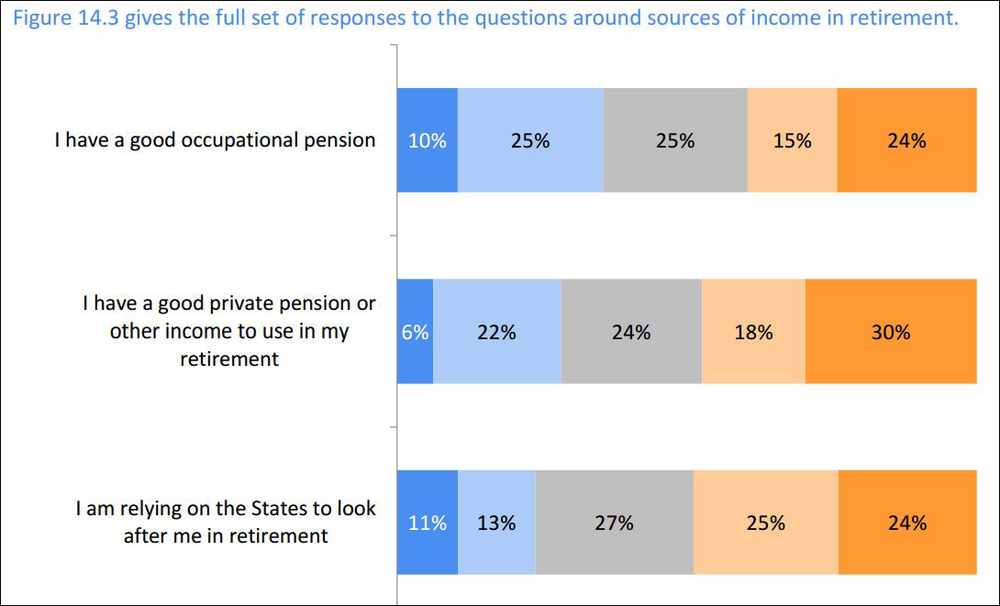

The figures, which form part of the 2015 Annual Social Survey, reveal that 52 per cent of adults in Jersey are concerned about their pension provisions. And nearly a quarter say they will be or already are solely reliant on income from the States during their old age.

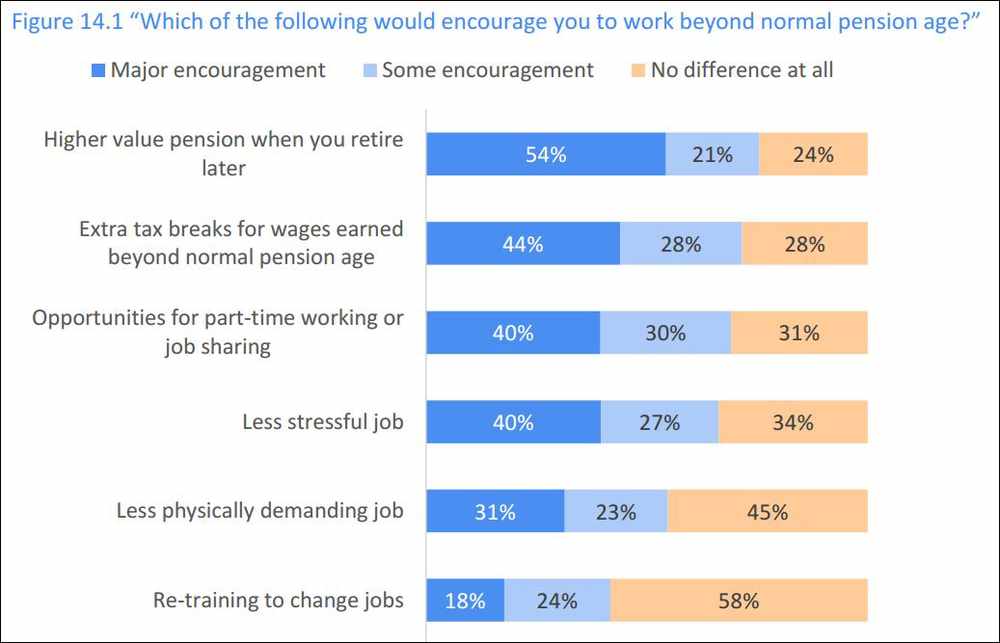

Half of the 1,660 Islanders who responded to the survey said they would need to continue working past the current retirement age of 65 if they were to maintain their standard of living, with 58 per cent admitting they would prefer to find a less demanding job as they draw closer to that age.

The results from the survey, which has been carried out since 2005 and is regularly used to help shape government policy, comes after the States recently voted to axe pensioners’ £83 Christmas bonus as a measure to help reduce the Island’s predicted £145 million structural deficit by 2019.

Speaking to the JEP about the survey results, Daphne Minihane, the chairman of Age Concern, said that finances were becoming a ‘major concern’ for older people.

She said: ‘These results are really not a surprise at all – older people are worried all the time about what’s going to happen to them.

‘They have already lost their Christmas bonus for next year and they do not get the extra benefits that they get in the UK, such as help with their heating. What’s more, there are likely to be extra charges that are coming on board – only yesterday the Social Security Minister said that charges on prescriptions haven’t been ruled out.

‘From an old person’s point of view, many of them are on seven, eight or nine prescriptions per month, which if the charge comes in would be an awful lot of money out of their savings. Some people are saying to me that they are not going to have enough money to pay for their funeral.

‘With winter setting in, some are now starting to think about choosing between heating their homes or eating – no one should end their lives like that.’

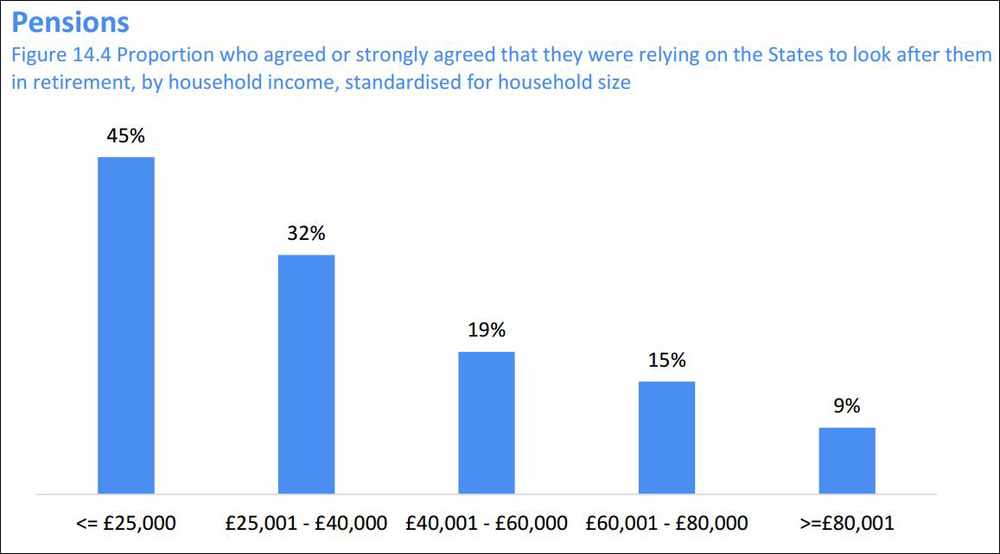

Malcolm Ferey, the head of Citizens Advice, said that retirement provision was an issue for Islanders. However, he said that because of a combination of an ageing population and governmental financial restrictions, the States could not be expected to provide for Islanders in the same way it had in the past.

‘More people do realise that to have a good level of comfort in their retirement it will be harder than it has been in the past,’ he said.

‘This generation of pensioners is probably riding more comfortably than the generation that is coming behind them in the next 15 to 20 years.

‘Like most western economies we do not have a bottomless pot of money. The days are now gone that you can rely solely on a state pension – I think most people realise that the state provision is only a basic level and that they need to make their own initiatives, but that can be worrying.’

Meanwhile, the survey also revealed that just over half (51 %) of all Jersey adults are either overweight or obese – a three per cent rise since the same data was collected in 2013.

More men were classed as overweight than women (16 %) and nearly two-thirds of adults (63 %) said they eat less than the recommended daily amount of fruit and vegetables.

Other topics covered in the survey, which was sent out to 3,200 random households earlier in the year, included St Helier, shopping patterns, religious views, speed limits, home satisfaction and government policy.

The Statistics Unit, which carried out the survey, said that because of the large response and the statistical weighting techniques they have used, the survey can be considered ‘broadly accurate and representative of Jersey’s population’.

Last month the JEP asked its columnists for their views on poverty in Jersey:

The damning report on inequality that was released late last week is not at all surprising. It fits nicely into a global trend, where the impacts of the economic crisis have been shifted onto the shoulders of the most vulnerable. The Organisation of Economic Cooperation and Development has described it as such:

Income inequality in OECD countries is at its highest level for the past half century. The average income of the richest 10% of the population is about nine times that of the poorest 10% across the OECD, up from seven times 25 years ago. Arresting the trend of rising inequality has become a priority for policy makers in many countries.

Apparently this has not been a priority for the Jersey government. First they introduced the zero-ten tax measures, which mainly benefited foreign businesses and shifted the tax burden onto the local population. Now the States have chosen the path of ‘austerity’, an economic strategy that has now been globally discredited. Not only does it not work, it has also deepened the divide between the haves and the have-nots in society. Nobel-prize winning economist Paul Krugman has highlighted this in numerous publications (http://www.theguardian.com/business/ng-interactive/2015/apr/29/the-austerity-delusion). Oliver Blanchard, chief economist of the IMF, has actually apologised for helping to push the austerity agenda.

THERE are always two sides to any argument.

On the one hand, who would want Jersey to become a ‘benefits’ society targeted by ‘scroungers’ wanting to live off the state? On the other, a comparatively ‘rich’ Island should surely not be seeing a higher gap between rich and poor than exists in the UK.

The dilemma for the Council of Ministers is that what some have been calling a waste of taxpayers’ money is a means of survival for low-income families and elderly people. Any government department is at best a blunt instrument. For every benefit recipient ‘swinging the lead’ there will be several more trying to cope with distressing circumstances.

One family I am aware of, facing the recent substantial cuts to disability benefit, have been told to sell their (modest) home and find somewhere cheaper to live (presumably social housing rented accommodation). Is that a balanced, practical solution?

Pensioners are facing not only loss of Christmas bonus and free TV licences, but over time a relative increase in tax on their private-pension payments (all in the name of the ageing population). And there’s more to come, with a proposed new health tax and sewage disposal charge.

This ‘support the rich to pay for the old’ mentality may look fine on the accountant’s balance sheet. But what kind of a society is Jersey becoming, when the number of outsize cars on the roads grows daily while crippling poverty is blighting 20% of Island residents? As other parts of the world demonstrate, social unrest, crime and poverty go hand in hand.

OUR Council of Ministers will get away with it, of course.

They will safely ride out the current public frustration over swathes of cuts to services because of one simple factor – fear.

The have us all terrified and, as such, prepared to tolerate the gentle turning of the screw in the last few years, which has seen the Island’s lower and middle-earners squeezed financially.

What are we scared of? That the finance industry, for so long the breast at which we have all suckled, might implode or crumble, causing an economical meltdown in Jersey that would take decades to put right.

Senators Philip Ozouf and Alan Maclean have for years banged the drum on behalf of finance, warning that any increases in taxes on corporations or higher earners would send wealthy fat cats fleeing for the exits.

But as the years go by, it is ever more apparent that zero-ten was nothing more than a tax system designed to benefit corporations. As a result, Islanders have been forced to swallow the introduction of GST, cope with pay freezes and deal with cuts to public services.

Jersey’s unique tax structure and finance industry was once justified by the benefits it afforded all Islanders, such as the trickle-down effect of cash swilling through the system, but its current incarnation benefits only those who can afford to influence the system or play the game.

It is impossible to ignore the fact that we live in a world which favours the rich. Despite a recession, the wealthy have seen their investments soar and it is estimated that by this time next year, the combined wealth of the richest one per cent of Earth’s population will be more than the remaining 99 per cent.

The way we look after the poorest, neediest and most vulnerable is, surely, a measureof society. The latest set of income distribution figures – an excellent and thorough piece of work produced by the States statistics unit – makes for miserable reading.

In essence, the rich get richer and the poor get poorer. But to sum it up in that one journalistic cliché doesn’t quite do it justice. It’s worse than that.

There are so many aspects of this study which reinforce the gulf between Jersey’s ‘haves’ and ‘have-nots’ – but there’s one particular detail, buried away on page 25 of the dossier, which saddened me most when I read it.

In the last five years, the average hourly income of almost everybody has gone up. For home owners with no mortgage, their pay has increased by 12%. For those wth ‘qualies’ who rent a home, their income has risen by 15%. And it’s up by 7% for those in social housing.

So far, so good. But look at the income of those living in non-qualified rental housing and you’ll see their hourly rate of pay has gone down by 13% in the past five years. Just digest that fact again… a whole swathe of society, those ‘have-nots’, whose hourly rate of pay has gone down by a double-digit amount.

If you’re earning a comfortable £40k a year (which you suspect these people are not), that’s the equivalent of a £5,200 cut in pay.

The Statistics Unit confirms that the richest 20% of Jersey households receive just under half (46%) of all income and the poorest 20% receive just one-twentieth (5%). The level of income inequality in Jersey is now similar to that reported by the World Bank for Russia or the United States of America, and well above the level of most Western European countries, including Switzerland and Luxembourg.

A recent discussion paper from the International Monetary Fund has highlighted the significant negative consequences of income inequality. The international analysis suggests that an increase in the income share of the richest 20% leads to a decline in GDP over the medium term, but increasing the income share of the poorest 20% leads to an increase in GDP. The Council of Ministers must undertake a serious review of its taxation policy and move away from the now discredited concept of trickle-down economics, if it is serious about a meaningful economic recovery for all Islanders.

A second theme developed is the damaging impact of rental levels on overall income. Recent government policy has been to increase social housing rentals to support a programme of refurbishment. The average social housing tenant is now spending over one-third (36%) of their income on rental costs, compared to just 12% spent by the average owner occupier in mortgage costs.

IF you are in the habit of speaking to the voluntary sector, last week’s news that the gap between the haves and have-nots is widening will have come as no surprise. Poverty – relative (ie, compared to you and me) and absolute – is widespread and worse than most can imagine.

It is also largely, other than for those at the sharp end of trying to alleviate it, off the radar. It makes us uncomfortable. These things can’t happen in prosperous Jersey and Guernsey, can they?

Three years ago, our chief medical officer got in trouble for daring to say that 5,000–10,000 islanders were living in relative poverty, that they had so little money their health was at risk and they and their kids were socially excluded.

Government’s response? They tried to shoot the messenger.

Yet an academic study in 2002 revealed over 3,000 households in Guernsey (16%) were poor, two-thirds of lone parents suffered poverty, as did 43% of single pensioners and a quarter of large households with children, while the cost and poor quality of housing was also an issue.

It will, I imagine, be broadly similar in Jersey.

Guernsey’s track record in this area has been to kick the can down the road; Jersey has a chance now to do something. Just possibly.

Why? Islanders tend to be suspicious of the poor – how much of it have they brought on themselves? They’ve all got Sky TV, you know. And smoke, etc.

But it’s not just political.

The Household Income Distribution Survey confirms that the cost of housing is a significant factor in the cost of living for Islanders. It is, perhaps, particularly important at the moment with rents being put up to 90% of market.

However, with social rented housing of some 4,500 homes, it would seem that Andium, as the owner of all social rented housing, is the major factor in the market. Given that, it seems incongruous to be putting rents up to 90% of market when the social rented housing supplier is in fact the market setter.

The income survey is quantitative, not qualitative. While there are subsets to distinguish between the old, the young, one-parent families and so forth. It is five years since the last survey. How changed is the population since the last survey? There are comparisons with the 2011 census but this assumes that there have been no changes since 2011. Would it also be useful for the Statistics Unit to follow a sample of the same families over a number of years?

The survey is also necessarily historic rather than predictive. It would have been useful if it had been available before the September debate on the Medium Term Finance Plan, such as it was. As a corollary to this, it would also have been helpful if Housing and the Treasury had made an impact assessment of how the changes in the MTFP would affect those subject to the changes.