Reform Jersey party chairman Deputy Sam Mézec has lodged a proposition calling for the Island’s minimum rate of pay to match the UK’s new national living wage of £7.20 per hour which is due to be introduced on 1 April next year.

A living wage is set above the minimum wage and is high enough to maintain a normal standard of living.

- Guernseys minimum wage rose by 20p to £6.85 an hour last month.

- The UK minimum wage (for 21- to 24-year-olds) is also going up by 20p an hour, to £6.70, from Thursday 1 October.

- In April 2016, the British government is planning to introduce a living wage defined as the minimum income needed to sustain a basic but acceptable standard of living for the over-25s.

- At present, UK employers are free to choose to pay a living wage. The current rate is £7.85 an hour but in London, which has a higher cost of living compared to the rest of the country, it is £9.15 an hour. Chief Minister Ian Gorst has pledged to consider introducing a living wage in Jersey.

Deputy Mézec said that low paid Islanders were struggling with Jersey’s high cost of living and that a recent States decision to increase the minimum wage to £6.97 next April did not go far enough.

He said: ‘There is no way that we can seriously argue that Jersey workers should suffer the indignity of a minimum wage that falls so far behind what any of us would consider an adequate sum to live off.

‘They are already struggling with a cost of living that is much higher than the vast majority of the United Kingdom.

‘This proposition seeks to provide an opportunity to stand up for our lowest paid workers and offer them something which will help them through the tough times ahead which they face.’

He also said that a higher minimum wage would help save the Social Security Department money as it would need to pay out less in income support to low earners.

The Deputy added that he felt businesses should not be concerned about Jersey’s minimum rate of pay matching the UK living wage.

He said: ‘Businesses should be more concerned about the lack of support the Council of Ministers is providing them.

‘They are taking £145 million out of the economy over the next few years, which will be money taken away from businesses. Evidence has shown around the world that austerity does not help business.

‘And raising the minimum wage will not increase unemployment. That’s what they said would happen when it was first introduced and it didn’t happen at all.’

He added: ‘Businesses would find a way to pay the higher minimum wage.’

The proposition will be debated in the new year.

There is no consistent way of calculating living wage rates across different jurisdictions with campaign groups in each country choosing their own method.

Governments are not responsible for calculating or setting living wage rates. Employers choose to register with a campaign group if they commit to using the living wage rate.

There has been a very limited take-up of living wage rates amongst employers in typical low wage sectors.

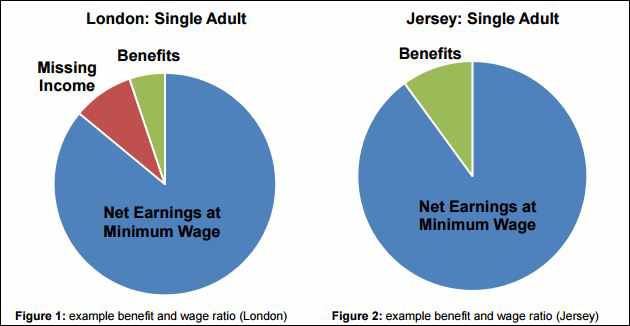

Based on the calculation used to set the London living wage, and adjusting for local costs, the minimum wage rate already in use in Jersey (£6.78 from 1 April 2015) satisfies the living wage requirement.

As Jersey’s existing minimum wage would satisfy the living wage requirement, there would be no savings to States expenditure (benefits and supplementation) or increase to States revenue (taxes). Even if a higher living wage rate is introduced, the number of workers who would see an increase in wages is likely to be very small, leading to very limited savings to States expenditure.

Increasing the minimum wage over time, as agreed by the States in 2010, would have a positive impact for all low wage earners.