- Number of OAPS has increased by 11 per cent in the last five years

- Figures show States pension cost per year has risen from £132 million to £160 million during this period

- Jersey’s growing ageing population may mean workers need to increase contributions to their old age pension

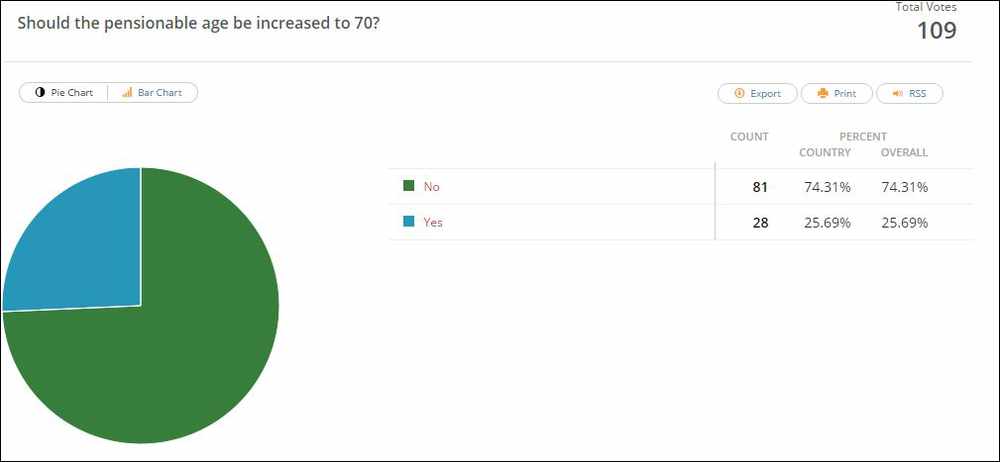

- Should the pensionable age be increased to 70? Check out the results of our recent opinion poll

WORKERS’ contributions towards old age pensions may need to increase in the future to cope with Jersey’s growing ageing population, the Social Security Department has warned.

New figures released this week have revealed that the number of Islanders claiming a States old age pension in Jersey has increased on average by almost 600 people each year since 2010.

At the end of last year, 29,582 old age pensions were being collected in Jersey, representing an 11 per cent increase in the last five years, and during the same period the cost of paying pensions has gone up from £132 million to £160 million a year.

Social Security policy and strategy director Sue Duhamel has warned that the growing cost of paying pensions and benefits is putting an increasing strain on her department’s finances and said that it plans to launch a major review into the matter.

She said: ‘In the next year or two, the cost of pensions and benefits will start to exceed the contributions that we collect and if no action is taken the entire reserve fund will be used up by the 2040s.

‘The Social Security Minister will be leading a major public consultation exercise next year, providing information on the way in which pensions are paid for and the options that we have to make sure that we can continue to afford to provide pensions in the future.

‘We will look at increasing contribution rates and contribution ceilings and at the range and value of the pensions and benefits that we provide.’

Ms Duhamel said that there was ‘no need for immediate action’ but added ‘we do need to start this process as soon as possible, so that we can continue to plan for the future’.

There are currently reserves of approximately £1.2 billion in the Social Security Fund, which is used to pay pensions and various other benefits.

Ms Duhamel explained that action taken by the States in the late nineties to address the ageing population had ‘put Jersey in a good position’ today and given it its large reserve balance.

She said: ‘Increases in contributions introduced by the Social Security Minister, Terry Le Sueur, at the time put us in a good position today.

‘But now we need to review our position and make sure that we plan for the future.’

She added that the working population in Jersey has always supported pensioners and that ‘we need to work out how that is going to continue to happen’.

Figures produced by the States’ Statistics Unit suggest that by the 2040s there could be two workers for every pensioner in the Island compared to the current ratio of four-to-one.

Ms Duhamel said that an increase in Jersey’s population would be required to keep the ratio of workers to pensioners at the current level. She added this considered as part of the review and could involve working with the population office.

IF, for a minute, we park the question of how the Island got into this fine financial mess and call a halt on the blame game, there are some serious questions to be asked about whether the proposed road map to recovery is being followed.

At the last count, the projected potential black hole stood at £145 million and we now know how the Council of Ministers proposes to reduce the deficit while also focusing extra spending on education, health, the regeneration of St Helier and fostering economic growth.

Wind the clock back a few months and the direction of travel was clear. Treasury Minister Alan Maclean said that new taxes would be a last resort. The focus was on cutting spending and finally bringing in check the cost of a burgeoning civil service.

That was not a comment on the quality of many hard-working and highly skilled people working for the States, but a statement of the obvious. The public sector could be more efficient, and everyone knew it.

Last week, the Medium Term Financial Plan was released and in it a raft of measures aimed at filling the black hole. There were cuts here and cuts there, many unpopular, but all aimed at a very necessary goal.

There were also proposed new charges for health and the disposal of sewage. Maybe not taxes in the semantics of political debate, but very definitely new taxes to everyone else.

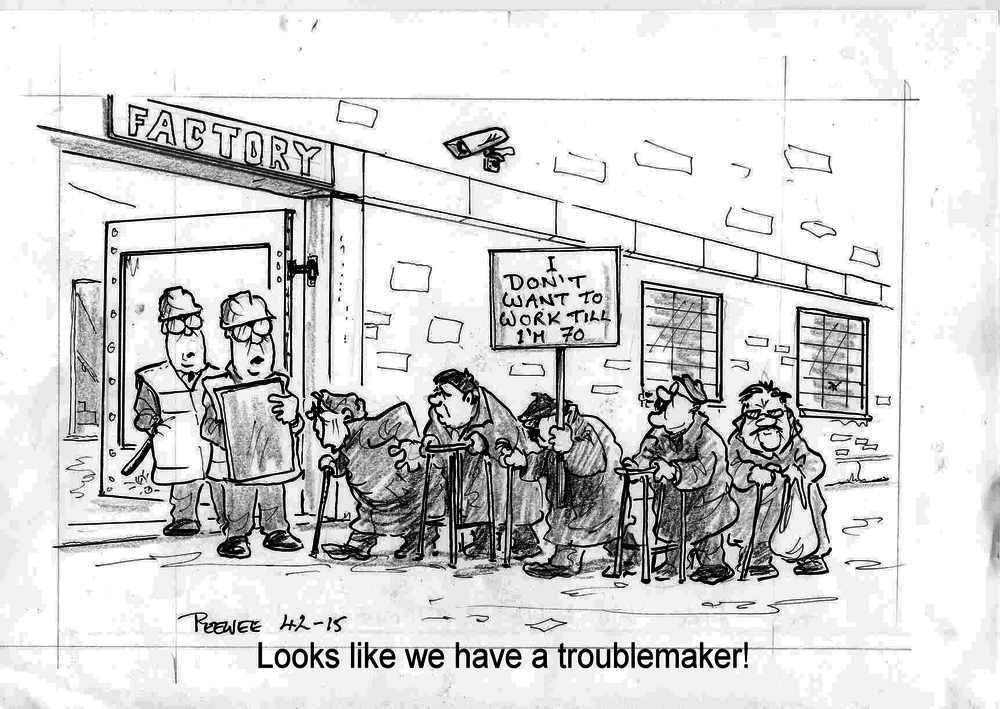

Today, we learn from Senator Maclean that the age at which Islanders are entitled to a States pension might rise – again.

The question is whether there has been a distinct, but underplayed, change of tack?

Have ministers really gone as far down the path of efficiencies and savings in the public sector as they led us to believe they would all those months ago?

Has Kevin Keen, a man brought in with a clear remit to bring some private-sector reality to the States bureaucratic monster, had his wings clipped by the mandarins who run this Island? Has he been denied the details he needs?

Yet again, Islanders are left seeking reassurance from their government in the face of a communication strategy which tells only part of the story. There seems to be a strange siege mentality among those on the upper floors of Cyril Le Marquand House. If there are people banging on their door downstairs, it is because they want information not blood.