Tensions between parties in the rental sector have existed for years, with no formal protection for money paid upfront by tenants.

Now, mydeposits, an organisation that has run deposit protection schemes in England, Wales, Northern Ireland and Scotland since 2007, has been appointed by the Housing Department to look after initial tenant payments from 2 November, when the scheme comes into effect.

Under the initiative tenants pay a deposit to their landlord, who must register the payment with mydeposits Jersey within 30 days or face a £2,000 penalty. The deposit is then held in an account by the company for the duration of the tenancy.

A £21 administration fee is taken from the sum by the organisation, which issues a certificate to confirm the deposit’s protection.

When tenants are due to leave they and the landlord must come to an agreement about how much of the original deposit should be returned, before contacting mydeposits Jersey to release the funds. Both parties must confirm the amount to be released before payment is made.

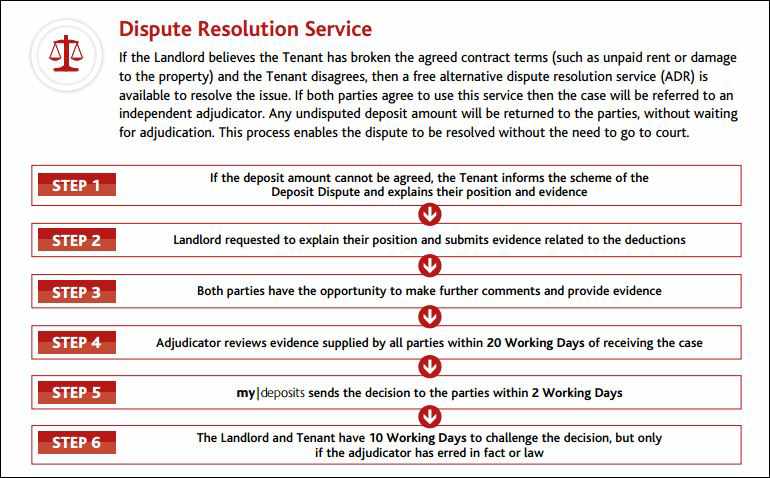

If there is a dispute over the repayment, the company also offers a free resolution service.

The scheme is designed to reduce deposit-related disputes in the rental market, which, according to 2014 figures from the Citizens Advice Bureau, account for ten per cent of all housing issues raised.

Housing Minister Anne Pryke said the deposit protection scheme was a significant step for tenants, landlords and letting agents in the Island.

She added: ‘I am pleased to have appointed mydeposits to operate a tenancy deposit scheme in Jersey. Mydeposits has considerable experience of operating the same schemes in the UK, and I am confident this will help landlords and tenants locally to better protect deposit money, creating a more transparent and fairer way to manage deposits.’

Eddie Hooker, the chief executive of mydeposits, said: ‘The introduction of the legislation and mydeposits will play a key role in improving tenant and landlord relationships in Jersey.

‘Our vast experience of operating successful schemes in England and Wales, Scotland and Northern Ireland since 2007 means that we are confident of delivering a service that will help raise standards in the private rented sector for landlords, letting agents and tenants.’

A number of workshops are due to be held in October for landlords, letting agents and tenants to find out more about the scheme. Online information is available at mydepositsjersey.je.

Tenancy Deposit Protection has been introduced to:

- Help to reduce the number of unfairly held deposits,

- Ensure that deposits are kept securely, in a segregated bank account,

- Ensure that deposits are returned quickly and fairly at the end of the tenancy,

- Help to improve the rental sector in Jersey.

How do landlords and agents comply?

It’s important that landlords and letting agents comply with the new legislation as those who fail to lodge the deposit with mydeposits Jersey within 30 working days of receiving it will risk facing a level 3 fine of £2,000.

It’s quick and simple to comply with mydeposits Jersey and the entire process can be completed in just a few simple steps but in nutshell you need to:

- Join mydeposits Jersey (available from 1 October 2015)

- Lodge your tenants deposit with us using your online account (available from 2 November 2015)

- We’ll then confirm the protection, safeguard the deposit and let your tenant know that it has been protected

- At the end of the tenancy, we’ll release the deposit when both parties have authorised it

- If there any disputes over the deposit return at the end of the tenancy then our free dispute resolution service is there to help

Tenant fees