- Plans to be submitted to build homes on site of online flower business in St Ouen.

- Company has been in decline since the Low Value Consignment Relief tax loophole closed.

- Jersey Choice says 70 jobs could be at stake if plans are rejected

- Do you think homes should be built on the site? Take part in our poll.

PLANS are to be submitted to develop a glasshouse site in St Ouen in the hope of saving a Jersey flower delivery company.

Following the decline of the fulfilment industry several years ago after the Low Value Consignment Relief tax loophole closed, flower delivery business Jersey Choice Limited began planning a housing development on part of its site on Rue de Grantez and Chemins des Monts.

Jersey Choice chairman and former Chief Minister Frank Walker said that if approved the profits from the scheme would be put back into the business, which employs around 70 people, to help secure its future.

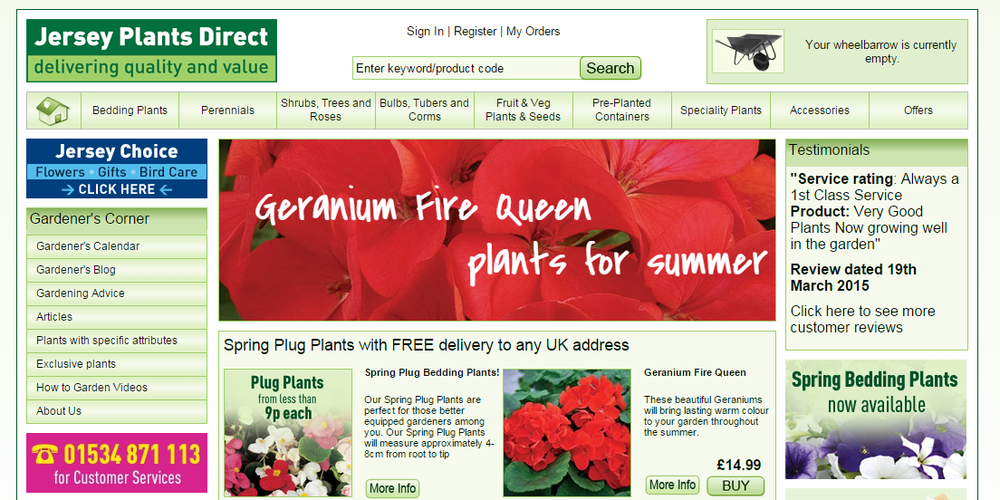

- Jersey Choice is an online business based in Jersey.

- Currently they sell a range of bird care accessories and supplements, gift bouquets, stationery and collectables.

- They say that they are dedicated to providing their customers with quality and value and delivering everything free with no minimum spend.

- Jersey Choice is the parent company of internet and mail-order plant company Jersey Plants Direct.

- Jersey Plants Direct sell a year-round range of Jersey-grown bedding plants, perennials, shrubs, vegetable plants and seeds, bulbs and gardening accessories.

- The company is a member of Genuine Jersey.

- For more information, click here

Mr Walker, who is not a Jersey Choice shareholder, said that if the scheme was not taken forward the business may have to be sold and that it was highly unlikely that a buyer could be found in Jersey.

Under the plans, which are still being developed, 13 homes would be built at the site for sale on the open market.

The two-, three- and four-bedroom units planned for the site, according to Jersey Choice’s calculations, represent an 88.7 per cent reduction of structures in the area.

However, Mr Walker explained that neighbours, who had been invited to two meetings about the project in the last 18 months, had expressed serious concerns about the potential amount of traffic generated by the development.

He added: ‘The whole basis of this plan is to keep a Jersey business in Jersey and to protect the jobs of our 70-odd employees.

‘Under the plans the glasshouses would go and part of the site would be returned to other agricultural use or returned to nature.

‘In our opinion it would be a much more beneficial site for neighbours than what is currently there, which can hardly be called attractive.

‘It would also remove the noise and nuisance associated with any commercial activity done in the countryside.’

Mr Walker acknowledged that neighbours had raised ‘huge concerns’ over the potential traffic increase, but said that Jersey Choice had gone to great lengths to listen to their views.

‘We’ve assured neighbours that we will be taking up the traffic issue with Planning and in the final submission,’ he said. ‘Some neighbours are strongly opposed to the scheme and some are in favour of it.

‘We told all those at the meeting that if they wish us to we will send them a copy of the submission that includes their comments.

‘We are not property developers and this is not something we would normally look to do.

‘If this fails the owner is likely to have to sell the business. There is no likely purchaser in Jersey and that would mean selling the company outside of the Island.’

- At the time, the JEP reported that 60 jobs and £2 million worth of freight business could be lost after Jersey Choice Ltd warned it could be forced to sell up after suffering a dramatic drop in sales since the loss of a tax relief.

- The business reported that its sales had plummeted from £20.2 million in 2010 to £10.9m in 2013.

- At the time, the JEP reported that if Jersey Choice is forced to sell, it will become one of a number of companies which have ceased trading, left the Island or reduced operations since the loss of LVCR, which allowed low-value goods to be exported from the Channel Islands to the UK VAT-free.

- The company claimed at the time to be the largest exporter between Jersey and the UK.

- Speaking in May 2014, Jersey Choice said that the sale of the business could be avoided if it managed to raise funds by redeveloping surplus glasshouses.

- It was revealed at the time that the business was working on plans to demolish several glasshouses in Chemin des Monts and Ruette de Grantez in St Ouen with initial, but then unconfirmed, plans showing they wanted to build houses on the land while turning much of it into Coastal National Park land, agricultural fields or landscaping.

- In a design brief produced by Waddington Architects, Jersey Choice Ltd said at the time: One option upon which the board has had proactive discussions is to sell the companys mail order brands Jersey Plants Direct and Gardening Direct to a UK business who would, in a short space of time, relocate all Jersey activities to the UK. This would result in the loss of 60 [fulltime] jobs and £2 million of north-bound freight-spend, thus adding significantly to the historically high unemployed numbers in the Island and to the difficulties sustaining the Islands crucial lifeline freight links with the UK.

- The brief added: However, we are a local company and, unlike nearly all other companies that were exporting to the UK under the LVCR scheme, we want to remain in our Jersey home. We would only undertake such a sale if we were able to raise the funds we need to sustain our long-term future by redeveloping one of our freehold glass sites.

- Low Value Consignment Relief was an administrative relief intended to lower the VAT collection costs of member states.

- Contrary to popular belief it was not introduced to help the horticultural industry. This belief may have been caused by a confusion between LVCR and a previous VAT prepaid scheme whereby Channel Islands companies were able to prepay VAT in advance, which was introduced to help horticultural businesses in 1973.

- Originally packages valued below an £18 threshold could be imported into the UK VAT free, but this limit was reduced to £15 in March 2011 as the UK began to rethink the loophole.

- From the 1990s Channel Islands based fulfilment companies seized upon LVCR, which allowed them to undercut competitors and sell CDs, DVDs and other goods into the UK without paying VAT.

- In 2012 Jersey and Guernsey lost a legal battle to prevent LVCR being scrapped. The blow had a huge impact on the Islands fulfilment industry, leading to job losses and companies closing or moving their businesses to other jurisdictions.