Global financial markets began last week in relatively calm fashion. President Biden’s renomination of Federal Reserve chairman Jerome Powell to serve a second four-year term as head of the nation’s bank lifted expectations of political stability, whilst the standout economic news was the 199,000 Americans applying for unemployment benefits, the lowest weekly total since 1969.

The tranquillity was swiftly and abruptly upended on Friday as news began filtering through of the discovery of a new and potentially highly transmissible coronavirus variant. Omicron, the 15th letter of the Greek alphabet, is the name now given to coronavirus variant B.1.1.529 by the World Health Organisation, who also designated the mutation a ‘virus of concern’ based on how it behaves.

A shortened US trading day on account of Thanksgiving was still ample time for the most dramatic ‘risk off’ trading day in over a year, as investors cut exposure and fled to lower-risk assets amid fears that a new and potentially harmful strain will trigger renewed economic lockdowns and weaken growth.

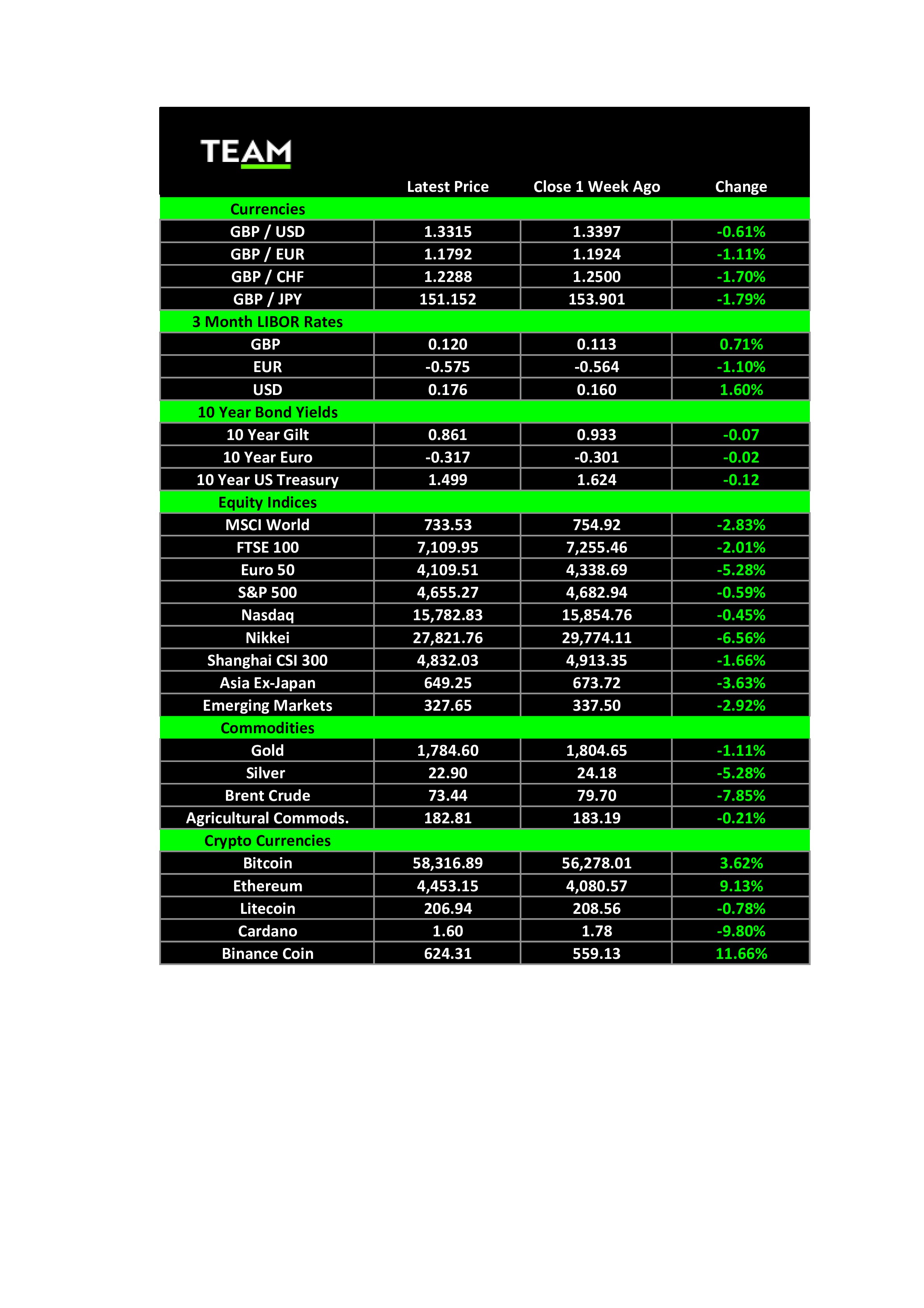

In the US, major markets were broadly down between 2-3% on the day, with the Dow Jones Industrial Index dropping over 900 points, or -2.5%. The S&P closed -2.3% and the technology-laden Nasdaq Index fell -2.2%. Shares in Europe corrected sharply (between 3-4%) on fears that the long-awaited return to normalisation might be derailed by the imposition of tighter coronavirus restrictions as government’s scramble to buy time and the virus spreads more quickly than anticipated.

Deteriorating sentiment extended to the commodity sector, where US crude oil prices were down an extraordinary -12% alone on Friday. The price fell to around $69 per barrel, the lowest level in more than two and a half months, as several nations moved swiftly to ban air travel from countries in South Africa, as well as adopting more heavy-handed domestic restrictions in the hope of containing the spread.

Government bond yields sharply reversed course in response to the coronavirus news and the potential impact on the outlook for economies and the path of interest rates. Bond prices had initially fallen early in the week, pushing the 10-year yield of the bell weather US Treasury Bond up to 1.65% on Wednesday. On Friday, prices surged, and yields tumbled to close the week at 1.499%. Similar price gyrations were observed in the UK Gilt market, with 10 year yields eventually settling at 0.861%.

Finally in our run-down, eye-catching moves in the crypto currency space (Bitcoin +3.62%, Ethereum +9.13%) masking plenty of volatility intra-week, giving weight to the argument that the sector has become a credible barometer of risk positioning and investor sentiment rather than a hedge against events like ‘Red Friday’.

Markets and risk assets staged a strong snap-back rally in Monday’s trading, suggesting the risks raised by omicron have been adequately priced – for now. However, the virus outbreak presents two separate and challenging uncertainties going forward; the ability of the variant to evade current vaccine efforts, and further government measures as countries seek to buy time pending more information. In Rumsfeld speak, we are in the realm of known unknowns.