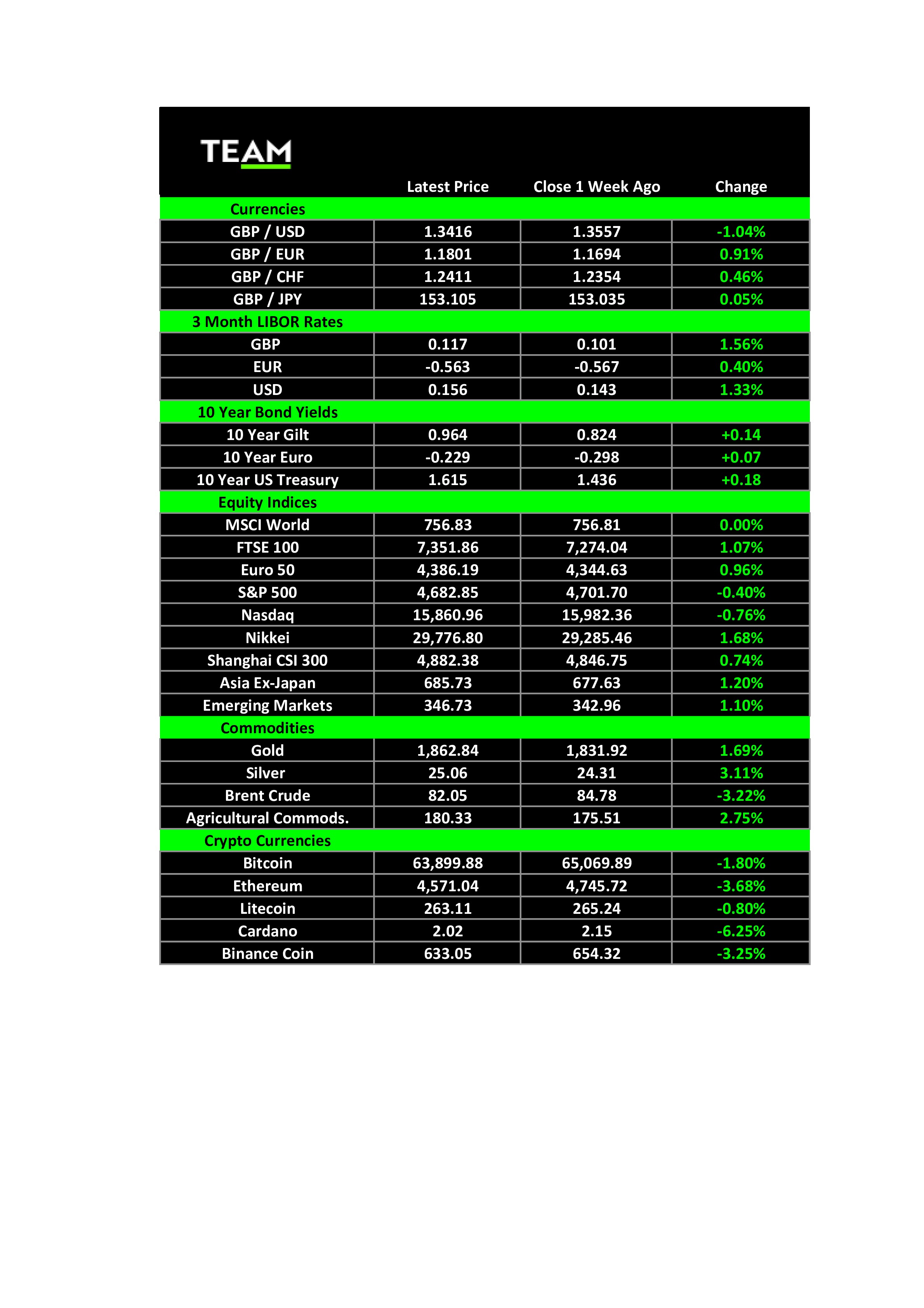

An eye-watering US inflation print took some of the air out of Wall Street stocks and it was the turn of European and Asian markets to shine last week – the Eurostoxx 50 and Nikkei indices gained 1.0% and 1.7% respectively while the S&P 500 fell 0.4%.

However, there was no shortage of good news stories on the other side of the Atlantic and the early backers of the electric vehicle start-up Rivian Automotive were heavily rewarded in the biggest US IPO since Facebook’s flotation in May 2012.

Its shares surged from the IPO price of USD 78 to USD 149 in just four trading sessions, giving it a market capitalisation of over USD 130 billion, already dwarfing the size of established automakers General Motors (USD 92bn) and Ford (USD 80bn).

The hype ahead of the IPO was no doubt magnified by the success of Tesla and some investors may be betting on it becoming the next trillion-dollar company in the sector, even if it is very early in the journey.

Rivian, which is backed by Amazon and Ford, has sought to differentiate itself as an adventure brand and it has attracted over 50,000 orders for its R1T pick-ups and R1S SUVs, as well an order from Amazon for 100,000 delivery vehicles by 2025.

Others are more sceptical and point out Rivian has so far delivered just 156 vehicles to customers and comparisons to Tesla are a stretch.

When Tesla listed in 2010, it was generating around USD 100 million in revenue. In contrast, Rivian is the largest US company by market value with no revenue.

It was revealed that US consumer prices rose 6.2% in October from a year earlier, the fastest rate in more than three decades, once again driven by higher energy, food and accommodation costs.

Surging inflation has pushed consumer confidence to a ten-year low and bond markets tumbled in the wake of the report, fearing the Federal Reserve will need to hike interest rates before next summer.

The interest rate outlook boosted the US Dollar which weighed on commodity prices, including Brent Crude which slid 3% to USD 82 a barrel. Energy prices were also dented by speculation that President Biden will release oil from the strategic petroleum reserve to lower fuel prices ahead of the holiday season.

Cryptocurrencies, including Bitcoin and Ethereum, retreated from near record highs in overnight trading on Tuesday.

The moves coincided with China’s state planner, the NDRC, announcing it will consider levying punitive electricity prices on companies involved in cryptocurrency mining.