The figure is a slight decrease on 2014, when 3,200 tax returns were filed after the official deadline.

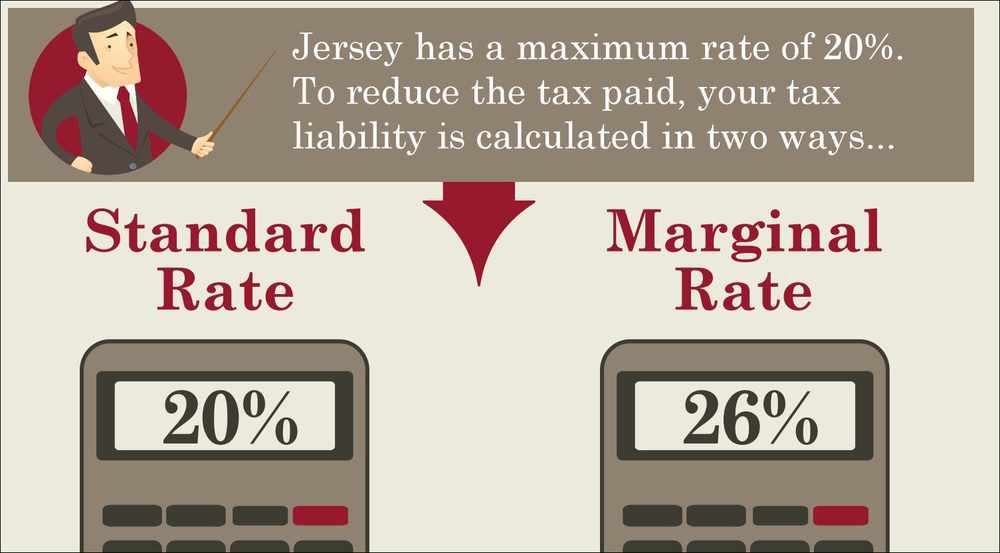

Jersey’s personal tax system is based on a standard 20% rate, with deductions and allowances.

However, to protect lower and middle-income earners a separate calculation of marginal relief is applied, using exemption thresholds. The taxpayer is charged whichever is the lower of the two calculations.

For example, for a couple with one child where the wife does not work and an income of £35,000, under the 20% tax rule there would be a £3,000 exemption for the child, resulting in a taxable income of £32,000 and total tax charges of £6,400.

But under the marginal rate, taking into account an exemption limit of £22,400 and £3,000 exemption for the child, an excess of £9,600 would be applied, with a total tax bill of £2,496 – a saving for the family of £3,900.

A simple guide can be viewed here.

Only a week before this year’s submission date, figures from the Taxes Office showed that 17,000 income tax forms were still to be handed in.

A States spokesman said: ‘This year, the total value of penalty notices issued is £759,000.

‘However, it is anticipated, based on previous years, that about half of the notices will be mitigated to nil once the returns are received.’

The spokesman said that if somebody was issued a penalty notice but it was later found that they were not liable to pay any tax, they would not have to pay the penalty.

He added: ‘While some people will have received a fine for not filing their tax return on time, they are still obliged to complete and submit a tax return form.

‘If anyone has any difficulty in completing their form, they should contact the Taxes Office.

‘Islanders who still fail to file their tax return could face legal action with a maximum fine of £5,000.’

Anyone wishing to launch an appeal against any late penalties had 40 days from the tax return deadline of 29 May to do so.

This date has now passed.

I have sent in my return after the deadline, but my tax will be less than the £250 fine

We’ll reduce your fine to equal the amount of tax we have assessed you for. (This does not take into account any payments you may have made to pay your bill.)

If I want to appoint an agent, what is the deadline?

In the year that the tax return is due, we need to receive your authority for the agent to act on your behalf before the May late filing deadline. If we do not, sending in the return is still your responsibility and you will get fined if it is late. The deadline for tax agents to send in the return on your behalf is the last Friday in July.

What action can I take if I don’t agree with the penalty?

If you receive a notice and believe there are exceptional circumstances which prevented you from delivering your return to us, you can appeal in writing. You have 40 days from date of the notice to do this.

The income tax law only allows us to waive the late filing penalty on the following grounds:

- death* (eg a close family member on, or around, the deadline)

- serious illness

- other grave or exceptional circumstances

Your letter should clearly state what the circumstances are. If we agree that there is a case for waiving the penalty we will advise you and cancel the fine. If we do not accept your reason(s), then you must pay the fine.

Examples of circumstances which have not been regarded as exceptional include:

waiting for information to include on the return the return being put in the post box just after the deadline postal delays temporary absence from Jersey (eg holiday or work related)

Can I appeal against your refusal to waive the penalty?

Yes. You have the right to appeal to the Commissioners of Appeal against our refusal to waive the penalty if you feel that you have grounds within the income tax law.

How do I appeal?

If you want to appeal, you must write to the Comptroller of Taxes at the Taxes Office within 40 days of being notified of our decision not to waive the penalty. Your letter must clearly state why you are appealing. See above for examples of unacceptable grounds for appeal.

You should enclose documentary evidence in support of your appeal. Your appeal will be acknowledged by the comptroller and listed for hearing before the Commissioners of Appeal.

When will my appeal be dealt with?